2020: A Year Like No Other

- January 13, 2021

Share this article

It seemed that the one constant in 2020 was upheaval. For everyone, it was a year full of ups and downs and while we know that no two people had the same 2020 experience, we have tried to capture some of what made it such a historic year.

“It was the best of times. It was the worst of times.”1 While Charles Dickens may have been describing the dichotomies and opposite individual realities brought about 250 years ago by the French Revolution and the Industrial Age, we find it an apt description for 2020 too. Whether you are thinking about the economy, the financial markets, political activism, or public health and Covid-19’s effect on our daily lives, 2020 was truly one of the most challenging years we’ve ever faced. Yet, despite all the negatives, we find ourselves reflecting on all the silver linings and green shoots that came out of this year. Here are some of the year’s highlights, with some thoughts on the implications for 2021’s investing outlook and financial planning.

For the financial markets, 2020 ended up being a strong year. Despite the first bear market in over a decade and the velocity at which equity markets went down, the US financial markets recovered quickly. 2020 might prove to be the only year in history when the DJIA plummeted from a historic high (29,551 on February 12, 2020) to a loss of more than 30% (19,174 on March 20, 2020) and made a full recovery to new all-time highs (29,824 on December 1, 2020) ALL IN THE SAME YEAR. The other major market indices followed similar patterns with a dramatic Feb/March drop followed by a rapid recovery. With Q4 2020 in the books, we now know that 2020 was a positive year for our major indices: the DJIA finished the year up 9.72%, the S&P 500 gained 18.4%, the Nasdaq soared with a 44.92% gain, and in fixed income, the Barclay’s Agg also returned a positive 7.51%.

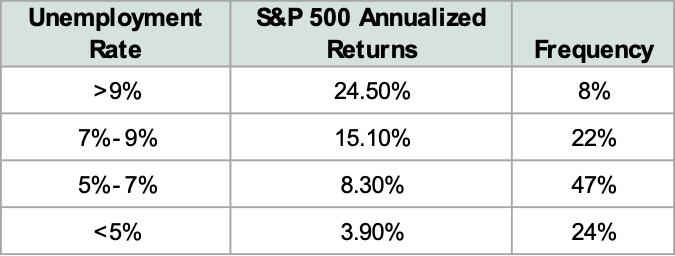

Economic uncertainties caused by the Covid-19 pandemic continue to remain, but the overall picture is starting to be a bit rosier. Unemployment remains close to 7%, up from pre-Covid levels but down significantly from the shutdown’s 14%+ peak unemployment in April.2 The market has continued to do well despite high unemployment rates and while that might seem counterintuitive, investing when things seem bleak often provides the best opportunities. Moreover, the stock market likes to try to forecast the future and seems to be indicating a belief in an economic bounce in 2021.

Unemployment Rate and Stock Market Returns

Source: Langlois, Shawn. “This Chart Might Have You Rethinking Your Approach to the Stock Market.” MarketWatch, MarketWatch, 13 Dec. 2020, www.marketwatch.com/story/this-chart-might-have-you-rethinking-your-approach-to-the-stock-market-11607886100.

Source: Langlois, Shawn. “This Chart Might Have You Rethinking Your Approach to the Stock Market.” MarketWatch, MarketWatch, 13 Dec. 2020, www.marketwatch.com/story/this-chart-might-have-you-rethinking-your-approach-to-the-stock-market-11607886100.

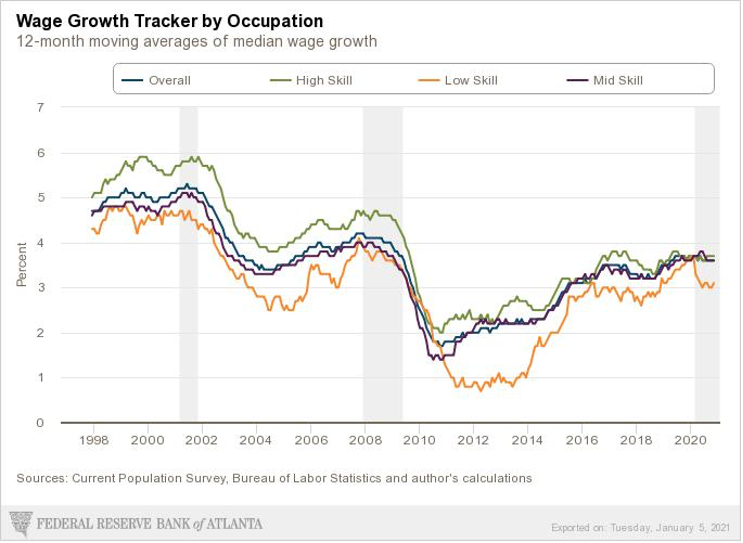

Job losses have been unequal and certain sectors, especially those impacted by tourism and hospitality, have been harder hit than others. This has meant that low-skilled (including but not limited to service sector, retail, and restaurant jobs) and low-income wage earners (income below 80% of the median income) have been hit disproportionately.3 However, prior to the Covid-19 pandemic, from 2015 to 2019, income growth among the 25% of Americans with the lowest household income exceed every other cohort – something that hadn’t happened since the 1990’s. Reasons for this were plentiful and included higher minimum wage laws and a low unemployment rate that benefited workers. As we move into 2021, the expectation remains that the Covid-19 vaccines will pave the way for us to find a sense of “normalcy” and there is a belief that, consequently, the labor market will retighten and provide the best benefit for the segment of the labor market that was the most adversely hit in 2020.4

Source: “Wage Growth Tracker.” Federal Reserve Bank of Atlanta, www.frbatlanta.org/chcs/wage-growth-tracker?panel=1.

This year has also highlighted the resiliency, ability to pivot, and innovation of certain sectors, and the FAANG-like (Facebook, Apple, Amazon, Netflix, Google) companies, insurance, and healthcare sectors have all had a strong year.5 While this has, perhaps, served to highlight the disparate impact of the coronavirus on the haves vs. the have-nots, it has also motivated charitable giving and renewed an interest in “community service.” As a high-profile example, MacKenzie Scott (ex-wife of Jeff Bezos, Amazon founder) donated $5.9 billion to charitable organizations in 2020 alone.6 #GivingTuesday 2020 was a record-breaking day and saw a 29% increase in donations compared to 2019. The world’s largest evaluator of nonprofits, Charity Navigator, saw an increase of 34% in dollars raised in 2020 over 2019.7

Another economic bright spot has been the US housing market – low supply compared to high demand, increased attractiveness for single-family homes in a socially distant world, and low interest rates have all spurred a surge in home prices that is expected to continue for at least the next few years.8 Low interest rates have proved compelling for first-time home buyers and Millennials and Gen-Z are expected to continue being supportive to the housing market. Single family home construction is expected to grow another 9% in 2021, which should continue to benefit home builders and construction sectors.9

The headlines this year and the volatility of the markets made it hard for even the most seasoned investor to “stay in their seats” and trust their investment plan. With the benefit of hindsight, we know that diversified portfolios performed well this year. The February/March drop was an opportunity to tax-loss harvest but staying out of the market too long would have made recovering any losses much more difficult. Since then, with an uneven recovery in various market sectors and asset classes, rebalancing and reviewing allocations continues to be important. Predicting market movements, like trying to time market highs or lows, is notoriously difficult and can be costly to your portfolio. After all, going back to 1930, being out of the market (as measured by the S&P 500) on the 10 best days in each decade reduced total return from nearly 15,000% (yes, that’s right!) to just 91%. Shortening up the time period to the last 15 years, which includes the “Great Recession” in 2007/2008, missing the 10 best days of S&P 500 performance would have lowered your total return from 330% to 96%!10

Missing the Top 10 S&P 500 Days in the Last 15 Years (2005-2020)

Source: Bloomberg, SPX Index. Data as of 12/31/20.

As we close the books on 2020, we want to express our gratitude to the most important people in our business: you! We are happy to have had the opportunity to serve you during this turbulent year, and we are eagerly looking forward to new opportunities in 2021. As always, if you have questions or concerns, or if you would like to take a fresh look at your financial plans or investment strategies, we would love to meet with you.

Sources:

1. Dickens, C., (1994). Tale of Two Cities. Project Gutenberg. Retrieved January 6, 2021 from https://www.gutenberg.org/files/98/98-h/98-h.htm

2. https://www.statista.com/statistics/273909/seasonally-adjusted-monthly-unemployment-rate-in-the-us/

3. https://www.bostonfed.org/publications/invested/series-one/issue-one/anatomy-of-a-quality-job.aspx, https://www.census.gov/data/tables/time-series/demo/income-poverty/cps-pov.html

4. https://www.theatlantic.com/ideas/archive/2020/12/the-2021-post-pandemic-prediction-palooza/617332/

5. https://www.businessinsider.com/jobs-industries-careers-hit-hardest-by-coronavirus-unemployment-data-2020-5

6. https://www.cnn.com/2020/12/15/business/mackenzie-scott-charity-donations-trnd/index.html

7. https://www.charitynavigator.org/index.cfm?bay=content.view&cpid=8357

8. https://www.reuters.com/article/us-usa-property-poll/u-s-housing-market-to-remain-a-bright-spot-in-a-weak-economy-reuters-poll-idUSKBN26L00M

9. https://www.forbes.com/sites/brendarichardson/2020/12/16/experts-predict-what-the-housing-market-will-be-like-in-2021/?sh=25c39d2036dc

10. https://www.cnbc.com/2020/03/07/when-you-sell-during-a-panic-you-may-miss-the-markets-best-days.html

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.