2021: That’s a Wrap

- January 15, 2022

Share this article

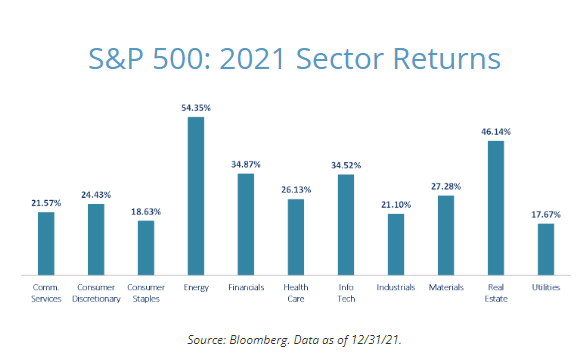

By almost any measure 2021 was a stellar year for the equity markets. For 2021 the S&P 500 returned 28.68%, the DJIA returned 20.95% and the tech heavy Nasdaq gained 22.21%. The S&P 500 notched 70 record closes, the second highest annual tally ever (behind only 1995’s 77 closing highs).1 For the first time ever, every single S&P 500 sector posted double-digit gains, with 9 of 11 rising at least 20%. The top three performers were energy, up 54.35%, real estate, up 46.14% and technology, up 34.52%. Rounding out the bottom three were industrials +21.10%, consumer staples +18.63% and utilities +17.67%. Fixed income was the opposite story. For only the fourth time ever, the Barclays Agg declined with a -1.54% annual return. The downturn has continued in 2022 thus far, with the Agg starting off with its second worst performance since its inception.

Yet despite the strong market data, 2021 often felt much more “doom and gloom.” We started the year with an attack on our nation’s Capitol and the political divide has continued to widen. Hope of “bending the curve” and moving on from Covid-19 has not come to be. Rather, new variants have caused the re-opening of America to be beyond bumpy and there is some serious Covid fatigue. It often felt that as soon as we started finding a sense of normalcy, new shutdowns were announced, “return to office” deadlines were delayed, and travel plans were second-guessed.

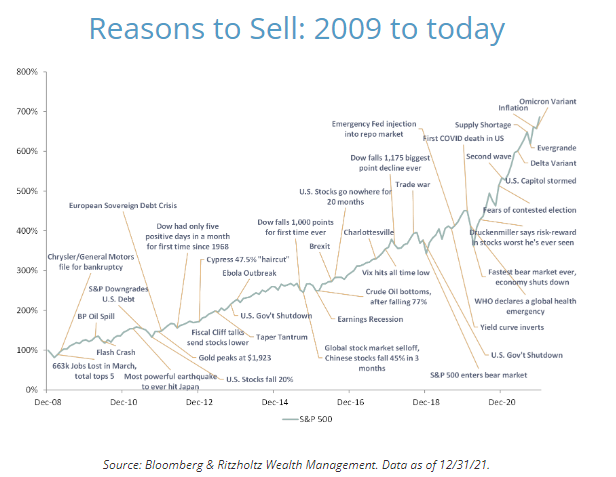

The equity “bull market” has continued despite, or maybe because of, this adversity. From 2009, when this bull market was born from the ashes of the Great Financial Crisis, this bull has continued to charge higher despite political, geopolitical, economic, social, and cultural crises. Along the way, there’s been a myriad of reasons to sell and many thought that this bull market couldn’t possibly continue, yet each time they’ve been proven wrong. One day the nay-sayers will be correct, and the market will decline but staying out of the market and waiting for that to occur isn’t an investment strategy that will yield profit over time. As we like to say, it’s about time in the market, not timing the market. Investing is a marathon (even if it feels more like a series of sprints!). 2

2021 Buzz (kill?) word: Inflation

Inflation generally gets a bad rap and 2021 saw inflation rearing its head. For the first time in a generation inflation is making its bite known. In November, Fed Chairman Powell stopped describing inflation as “transitory,” although economists continue to debate if a transition from a deflationary environment to an inflationary environment is truly taking hold, or if it is still just supply chain repercussions. Either way, we’ve all felt it when we’re digging deeper into our pockets at the grocery store, the gas pump, or when the bill hits the table at the restaurant. Although only time will tell, supply chain strains and energy prices are showing signs of peaking. With Fed and Congressional aid also slowing, inflation may also be peaking.

There is often an emotional component associated with inflationary environments and a hoarding mentality can take hold of consumers if they begin to feel that the price for their goods will be dramatically higher soon. Yet while inflation is a pain to our wallets today, there is a silver lining: inflation chips away at the debt burden of people who owe money, a tiny favor that anyone with a mortgage or student loan can be grateful for. 3

Think of it this way: ten years ago, a candy bar costed you $1. Today, that same candy bar would cost you $2. Ouch, that’s inflation! But let’s say that instead of paying outright for your candy bar, you had borrowed that $1 from a friend. You gave your friend a quarter in collateral and told them that every year for the next decade you’d give them a dime if they would loan you a dollar. They agree and today, after ten years, you’d have paid them back a total of $1.25 (ten dimes and your original quarter). You now completely own a candy bar worth $2. Even though you ultimately paid more than the original $1 price for the candy bar, you’ve made money since inflation has caused the worth of the candy bar to double! While no one wants a candy bar that’s been sitting around for a decade, the same principles apply for a mortgage, student loan or other debt. If you have a mortgage with a 3.5% rate and inflation is at 6.5%, the dollar you pay the bank back with is worth less (in purchasing power) than the dollar that you borrowed when you took out the loan.

Like with anything, there are investment winners and losers in inflationary periods. Historically, common inflation hedges have included equities, real assets like commodities or real estate, and TIPS. Bank stocks also often perform well. So far, US bank stocks have had a strong start to 2022 as the acceleration of loan growth and an expectation for rising rates benefit their businesses.4 Value stocks, compared to growth stocks, are also expected to benefit from raising interest rates. Higher interest rates reduce the values of companies’ future earnings, weighing more heavily on shares of fast-growing companies with much of their profits in the years ahead.5 Cryptocurrency has also been floated as an inflation hedge. Yet crypto is still a nascent industry and any discussion of it as an inflation hedge needs to be prefaced with how susceptible it is to market jitters and gyrations. Moreover, its ability to improve returns over the long term or through an inflationary environment has yet to be proven.6

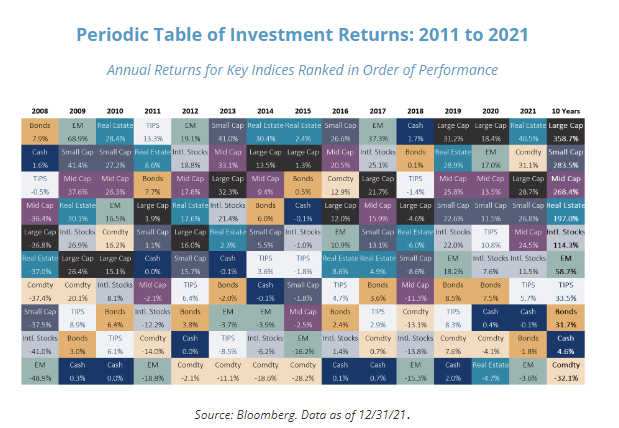

One thing is certain, holding a diversified portfolio has historically been a way to reduce volatility and grow wealth. The market is fickle and what has been a historical norm may, or may not, continue in the future. However, in different years, different sectors and different asset classes perform better or worse than others. As the Periodic Table of Investment Returns (above) shows, the asset class that performed best last year might not perform as well this year and vice versa. Last year’s worst performers may be this year’s best! A diversified portfolio with a mix of investments minimizes the chances of any one asset hurting your portfolio, although you do give up “to the moon” type gains. The net effect should be a portfolio with more steady performance and smoother returns.

Subscribe To Our Newsletter

Sources:

- https://www.cnbc.com/2021/12/30/stock-market-futures-open-to-close-news.html

- https://theirrelevantinvestor.com/2021/12/31/10-lessons-from-2021/

- https://www.fool.com/investing/2021/12/16/inflation-isnt-bad-for-everyone-just-ask-debtors/

- https://www.bloomberg.com/news/newsletters/2022-01-13/how-will-inflation-fed-interest-rate-hikes-crypto-crash-hit-stock-investments

- https://www.bloomberg.com/news/articles/2022-01-03/cheap-stocks-to-finally-have-their-day-in-2022-investors-say

- https://techcrunch.com/2022/01/09/the-rich-get-richer-rethinking-bitcoins-power-as-an-inflation-hedge/

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.