You’ve Got Options: Compensation Package Edition

- November 1, 2021

Share this article

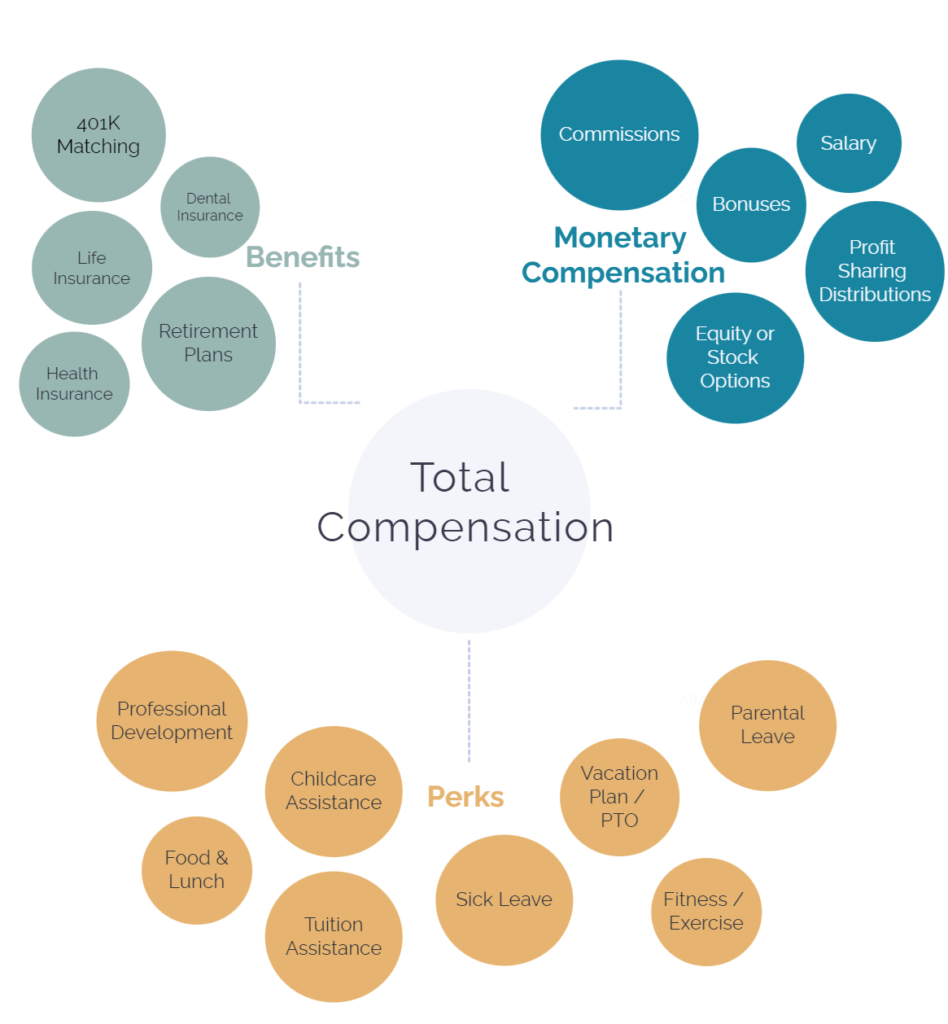

As businesses reopen and vaccination rates climb, the U.S. economy continues to grow and many workers are re-evaluating their jobs and making decisions about their next career move . In the blink of an eye, the pandemic changed the way we conduct our work lives. For many of us, pandemic working has highlighted what we value the most in our careers. With less of a willingness to compromise for anything less, there has been a resulting uptick in job and career changes over the course of the last year. Executives in search of that coveted new role, now find themselves , back to the drawing board negotiating (and prioritizing) compensation packages. While compensation packages can vary greatly in terms of what they include, it’s paramount to understand the total value of your package, including what is and what is not included. For example:

Scenario A: You are offered a salary of $250K, full health and dental benefits, life insurance, 3% employer matched 401k, a month of PTO annually, and company equity.

Scenario B: You are offered $150K, partial health and dental benefits, two weeks of PTO annually, and up to $200K annually in performance-based commission.

Which do you choose?

The answer is, there is no easy answer. $350K trumps $250K, yes, but what about the total value of the non-cash benefits? How valuable is vacation time to you? Do you have a family relying on your benefits? What if you don’t hit the performance metrics for your commission?

When it comes to accepting a total compensation package, each individual’s priorities will determine which choice is right for them. An employee who is 22 years old and still on their parents’ health insurance will value a fullbenefits package a lot differently than a 45-year-old woman with three small kids at home who are all relying on her health insurance. Additionally, it’s important to take into consideration pre versus post tax savings for each benefit. While free onsite childcare provided every day might not seem life altering, understanding that your childcare money is otherwise a post-tax expenditure means that the company provided daycare is that much more valuable, both monetarily and in time savings. Of course, with each option provided to you there are careful considerations you should make before you sign a contract and commit to a package.

Total Compensation: A Breakdown

Total compensation includes much more than just money paid to an employee. Examples of benefits that are most often provided within a total compensation package include:

Base vs. Bonus Pay

While you’re probably not going to turn down a bonus or commissions, negotiating your base pay is worth prioritizing. An increase in salary is fixed and will impact your long-term savings potential, while a bonus is a one-off chunk of compensation that can fluctuate greatly at any moment based off personal and company performance. Bonuses are taxed less favorably than base salary, as they are seen as supplemental income instead of base pay. Typically, bonuses are calculated as a percentage of your base salary, so the higher your base is the higher your bonus will likely be. Additionally, if you plan to make any lateral career moves you can continue to build on a higher salary with every new job you take.

The choice between base versus bonus pay should also be considered when thinking about your personal finances and lending prospects. For example, a pay structure is closely analyzed when applying for personal loans, such as mortgage financings or re-financings. Not only do you need to have the savings for a down payment, but lenders are also very focused on your ability to be able to make your monthly payments. Stable income that is received consistently (this could be a base salary, child support, alimony, etc.) allows lenders to predict your future earning potential. Commissions, bonuses, and other less steady income are more difficult to predict and are therefore considered less stable, so have the potential to impact the rate a mortgage lender is willing to assign to you.

A Closer Look at Stock Options

Stock options are one of the more confusing and volatile aspects of a total compensation package. They have the ability to make you wealthy, but they could also lose their value at the drop of a hat. Employee stock options, or ESO’s, enable but do not obligate an employee to purchase a certain number of shares at a specific price and point in time. Most often ESO’s are given to manager and officer-level positions and are meant to incentivize new hires and retain key employees, all while preserving cash for the company. To learn more about stock options, check out our blog Take Stock of Your Stocks.

The Intangibles

While monetary value has a large impact on our job choices, it’s also important to consider the intangible benefits that may also be of value but are harder to quantify with a dollar amount. If your company allows you to work from home a few days a week, this may cut down on other costs associated with going into the office (gas, tolls, train tickets, dog walkers, dry cleaning, etc.) and may also decrease your stress levels. A company’s culture and values could also have an outsized impact on our feelings towards one employer versus another. For example, if a company pledges to match charitable donations each year this could be an added benefit that doesn’t directly impact our take home pay. Or perhaps your company provides wellness benefits that may have an outsized impact on your mental health and work output.

Between the quantitative values and the intangibles associated with different job opportunities, each one of us is going to gravitate individually depending on our personal circumstances and priorities. We suggest taking the time to carefully think through a compensation package before agreeing to it and understand that packages are meant to be negotiated. Need a second opinion? Let the Treehouse Wealth Advisors team help you think it through.

Subscribe To Our Newsletter

Sources:

- https://www.monster.com/career-advice/article/how-to-compare-total-compensation-packages-0722

- https://www.businessinsider.com/salary-cut-vs-stock-options-join-startup-2016-10

- https://www.indeed.com/career-advice/pay-salary/salary-vs-total-compensation

- https://careersidekick.com/negotiating-salary-3-reasons-why-base-pay-trumps-everything-else/

- https://hire1h.com/blog/base-salary-bonus-employees

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.