Debunking Debt

- July 14, 2021

Share this article

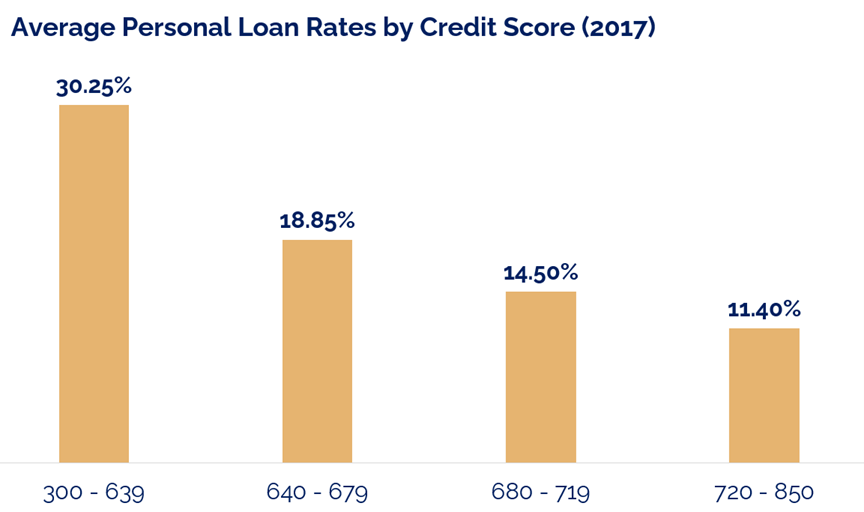

To put it simply, debt is money owed by one party to another party. While sometimes taking on debt may not be the best financial choice, there are also several good reasons to take out a loan. However, while a loan approval from a lender means you can borrow money; it does not mean that you should borrow money. It’s important to carefully assess any debt before you commit to taking it on to make sure it will help you meet your financial goals. Are you trying to grow your business by taking out a business loan? Or are you taking out a personal loan to plan a vacation that you wouldn’t otherwise be able to afford? The decision to take on debt is not always clear cut, as sometimes debt will allow you the opportunity to invest in something (yourself, your business) but the return on that investment won’t be realized until years down the road. However, the interest rate and the purpose of the debt can help determine if it’s “good debt” or “bad debt.”

Secured vs Unsecured Debt

There are two types of debt: secured and unsecured. Secured debt means that the borrower has pledged a real asset as collateral for their loan. For instance, with a mortgage, the borrower “secures” the loan with their house. If the debt is defaulted on and the borrower misses payments/cannot repay the loan, the creditor can foreclose on the house and take possession of the asset. Since there is a real asset that is guaranteeing the loan, the interest rate on these debts tends to be lower than the interest rate on unsecured debt.

Unsecured debt is debt that is not backed by a tangible asset. A common example is credit card debt. If the borrower cannot (or chooses not) to repay the credit card loan, there is no asset for the creditor to claim. There are, of course, consequences for not repaying the debt (like wage garnishment and lowered credit scores) but since there is no direct collateral, it can cost the creditor time and effort to try to recuperate the funds lent. Consequently, the interest rates on unsecured debt tends to be significantly higher than secured debt.1

The Good, the Bad, and the Ugly

The old adage goes, “there’s two sides to every story” and that’s certainly true when it comes to debt. On the plus side, some debt falls along the lines of low-interest borrowing and helps you increase your income or net-worth. On the flip side, however, it can be easy to take on expensive (high interest) debt to solve an immediate want or problem that ultimately drags down your financial situation.

Take, for instance, student loans. Many consider education to be “an investment in your future,” but the cost of higher education is often unattainable without financial help. About 62% of the class of 2019 graduated with an average student loan balance of $28,950. Close to 1 in 8 Americans have student loan debt and those currently aged 35-49 owe the greatest amount. 2,3 With the extraordinary cost of higher education, some may wonder if taking on debt to attain a college diploma is worthwhile. For most, it is a worthwhile investment as college graduates typically earn much more than those with only high school diplomas. However, it is worth noting that individual incomes depend on occupations and performance and taking on student debt isn’t a guarantee for higher income.4

Similar logic can be applied when thinking about business debt; whether the debt is a good decision or bad decision depends on what the additional funds will allow you to do. Will a business loan allow you to grow your business or will it end up being a weight that drags on profitability? Only 48% of small businesses have their financing needs met, including those that have small business loans. That means that if you’re a business owner, you’ve likely thought about applying for a loan to help grow or support your business.5 Understanding small business loans can put you in a stronger position to determine what the best option is for your company. The lender, loan type, your personal financial situation, and your collateral will all impact the interest rate on a business loan. Online lenders tend to have looser eligibility than traditional banks but the interest rates can be significantly more. The best rates are often on loans backed by the US Small Business Administration but they’re harder to qualify for and the application process is comparatively long and rigorous. Like other loans, your credit score, business experience and collateral can also impact your interest rate.6,7

Other debt that allows you to make an investment includes a mortgage. Buying a home is likely the largest personal finance decision you’ll make and it’s a decision that is likely to last decades and cost hundreds of thousands of dollars. While there are many factors when choosing to buy a home , getting a mortgage is what makes it financially possible for most of us to buy a house. Keep in mind that a house is also an investment and when you pay your monthly mortgage, you are paying off some of your loan but also putting more money into your investment – in a way, it’s a little like moving money from your right pocket (your savings) to your left pocket (your house). The goal is to not “drop” too much of it (through interest) while it’s moving from one pocket to the other.

Student debt, business loans and mortgage debt are all ways to “leverage” your current assets to give you more resources to continue building your wealth. The expectation is that you will ultimately be making more money than you would be paying in interest on the loan. However, if the interest rate is too high or the new venture isn’t profitable, it may not be worth taking out the loan. The “ugly reality” of debt is that, while it may seem like a good idea at the time or get you through a tough financial spot, expensive debt can drag down your financial situation.

Are you currently considering taking on debt? If you would like to talk to a financial advisor for a second opinion, or if you have any questions about borrowing money, please contact our team.

Subscribe To Our Newsletter

Sources:

1. https://www.nerdwallet.com/article/finance/debt

2. https://ticas.org/affordability-2/student-aid/student-debt-student-aid/student-debt-and-the-class-of-2019/

3. https://www.nerdwallet.com/article/loans/student-loans/student-loan-debt

4. https://www.manhattan-institute.org/high-school-college-wage-gap

5. https://www.fundera.com/resources/small-business-lending-statistics

6. https://www.nerdwallet.com/article/small-business/small-business-loan-rates-fees

7. https://www.nerdwallet.com/article/small-business/types-of-business-loans

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.