The Evolution of Retirement

- April 30, 2021

Share this article

“The only constant in life is change” – Heraclitus

Today’s retirees and soon-to-be retirees are more energetic than ever before. For many, the definition of “retirement” has evolved beyond idyllic twilight years to more active and vigorous “second chapters”. So, what is your retirement dream? Do you imagine “working” in some capacity, starting a new business or are you planning to sit on a beach and drink margaritas? Volunteer or travel the world? Move to a different country or find time to spoil your grandkids? The possibilities are endless and each of our retirement ideals is unique. Who says it must be an “either/or?” We think it should be an “all of the above”!

Active retirements and longer life expectancies mean that we’re spending more money during our retirement years than previous generations. Proper planning can provide confidence that you won’t outlast your retirement funds and, as with much of life, the earlier you start preparing, the easier it is to ensure you’re on the right path!

Prior Proper Planning…

“Prior Proper Planning Prevents Poor Performance” was a common phrase in my household growing up. My mother said it so often I was sick of hearing it, but when it comes to planning for retirement that advice remains true! Technological and healthcare innovations have helped us redefine “retirement” by extending our lives and improving the overall quality of our later years. It also means that we now need to plan for much longer retirements than our parents or grandparents.

If you were born in 1860 in the United States, your life expectancy was 39.41 years.1 Since then, major strides in our understanding of nutrition, improvements in medicine, technological advancements have all contributed to greatly increasing our life expectancy. Today, the United Nations projects that the life expectancy in the U.S. in 2021 will be 78.99 years. However, once we reach the milestone age of 67 which is benchmarked by the Social Security Administration (SSA) as “Full Retirement Age”,2 our life expectancy increases drastically to 85 for men and 87 for women. Our longer life expectancies mean that today planning for a multi-decade retirement is a reality we should all be prepared for.

Pensions, Social Security, oh my!

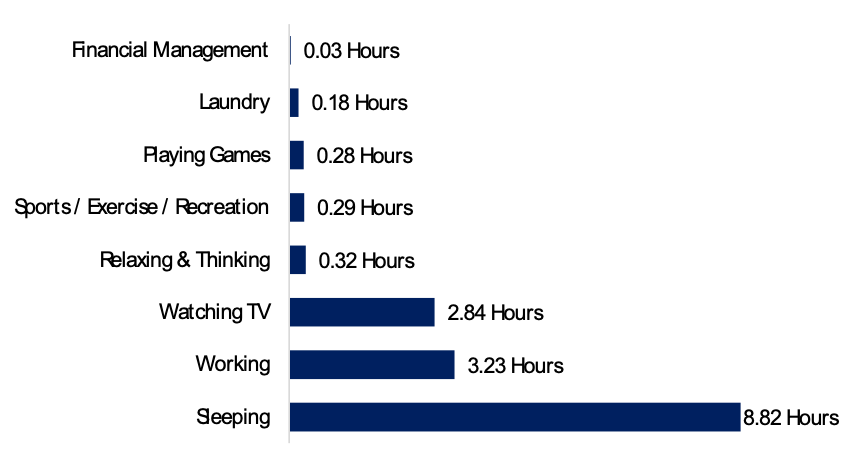

While many of us dream of retirement and how we’ll fill our days, we haven’t spent the time to make sure we’re financially prepared. In fact, a 2019 report showed that while 48% of Americans want to be financially prepared for the future, 97% aren’t making time to do so. The average American spends two hours and 50 minutes watching TV (pre-pandemic, too!) versus less than two minutes daily managing their household finances; that’s almost 100 times as much time spent watching TV compared to managing their finances!

Time Spent on Personal Finances Vs. Selected Activities

Evaluate, Learn, Review….

If you evaluate your retirement plans and put in some effort early, you can be prepared for whatever path you may choose.

#1: Start by evaluating your priorities: what are your must-haves vs your would-be-nice to have?

#2: Next, bolster up your financial literacy. Understanding where your money is, how to manage it, and when to ask for help can benefit us all; especially Seniors whose well-funded retirements made them ideal targets for frauds and scams.

#3: This is also the ideal time to learn about retirement savings options and review your retirement accounts. By now, most of us know that if we have a workplace retirement plan and our employer offers any matching, we should contribute at least the amount they’ll match – if not we’re just leaving free money on the table! However, even if you don’t have access to a workplace plan, you have options for retirement plans. If you have earned income, you can open an IRA or, if you’re self-employed, a SEP IRA or a Simple IRA (which have higher contribution limits). For many, a Roth IRA or Roth 401(k) can make sense as well. Time is on the side of those that start younger but many of these accounts also have “catch up” provisions for older savers.

#4: Finally, give your investments a check-up. Take into consideration your time horizon and your risk tolerance. Being more aggressive with your investments might make sense if you’re young with many working years in front of you but as you near your retirement age, if you can afford to take some risk off the table, it is often advisable.. We also suggest simplifying your finances where it makes sense – consider consolidating your old workplace retirement plans and if your current workplace is one of the few still offering a pension, consider the various options if you choose different payouts.

If you need help, ask! We know there are more resources than ever before, and, at Treehouse Wealth, we’re here to help you sort through them. We spend time getting to know you and looking at your goals so that we can create a tailored plan for your future. Reach out today.

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.