Talkin’ ‘Bout My Generation: How Our Age Demographic Impacts Our Investment Decisions

- February 26, 2021

Share this article

Biases, or judgements and determinations that humans make, occur in everything we think about and act upon, beginning at a very young age. Sometimes these biases can lead us to make the right choice, but often we rely too heavily on flawed reasoning, emotion, or intuition to make a decision. Biases can be rooted subconsciously in psychology (our emotional and cognitive biases) or consciously based on our age and experiences (sociologically). It is impossible not to let the biases that we form over time influence the way we think about everything.

While each person develops a unique set of biases based off their own personal attitudes and experiences, researchers have found that there are many biases that are shared among age groups and specific generations. It may seem odd to share biases with someone we’ve never met before, but it is more than likely that we share certain memories and experiences with others in our age demographic that can influence the way that we think about certain things. This applies to many different categories of thought, including the way we think about money, how we choose to save, what we decide to invest in, and what wealth means to us.

Researchers have found that the most important time period for memory development and strengthening generational identity occurs during the Reminiscence Bump. If you ask someone to list their most vivid, memorable life events, the odds are high that many of them will have occurred between the ages of 15 and 25, during their Reminiscence Bump.

The events that occurred during this time period in each of our lives tends to stick with us, and impact our biases and decision-making moving forward.

Because of this, it is likely we share certain biases and characteristics with others in our age demographic. This can impact everything from our communication style to our investment decisions. For example, the Silent Generation tends to value connectedness and prefers face-to-face communication, Generation X leans toward calls and emails, and Millennials prefer electronic communication via text, email, or videoconferencing.

The communication style that was prevalent during our formative years tends to stick with us even as new communication styles and technologies become available.

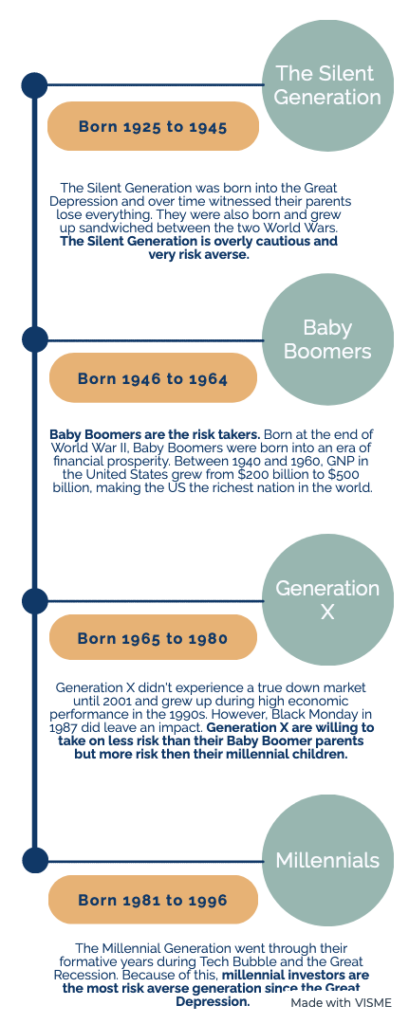

So, how does this impact our attitude toward investing and why does it matter? While there are many different factors that go into an individual’s willingness to take risks with their investments, the societal, economic, and political environments that occurred during our formative years have a profound impact on our ability and willingness to take risks as well. The strong generational differences that lead to the amount of risk in our investment portfolios can lead to wealth inequality between generations and hinder our ability to meet our financial goals. Unlike some of our other biases, the generational effect on our risk attitudes do not change with our age. Generally, a younger investor at the beginning of their career who is saving for the long term should have a stronger risk profile than an investor reaching the age of retirement who plans to start spending their savings sooner.

Now, think about your formative years (between the ages of 15 and 25) and what economic climate existed. Can you think of any memories that may be impacting your investment decisions? Big, generational wide events may form our biases in ways that are easier to spot than individual-specific money memories, but both impact the way we think and our attitudes toward wealth and investing. Events that trigger negative associations with money like the Great Recession (generational) or having your home foreclosed on due to a bad family investment as a child (personal) may lead to more conservative attitudes toward investing. Over the long run, this may lead to less aggressive investing and/or saving which makes it harder to attain long-term financial goals (check out our blog post on how emotions interfere with long-term investing for more information on missing long term goals).

The importance of having a financial advisor is to help you understand what biases you may have in place and offer an objective investment experience free from those biases. If you’d like to further understand how these impact your investment decisions, reach out to our team to learn more!

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.