How to Feel Confident Your Personal Finances Are in Check

- April 23, 2020

Share this article

We believe that it is always a good idea to prepare your finances so you are ready to handle anything that might come your way. While it may feel easier to conquer financial checklists during less volatile times, we have come up with ways to become more resilient, both emotionally and financially, during tough times as well. If you have time on your hands and are looking for ways to become more financially secure, here are some steps you can take:

1. Build an emergency fund

Think about building an emergency fund so you have cash reserves available if you need them. This should be the equivalent of at least three to six months of your expenses.

Start by making sure you understand where your money is going and how much you spend each month — both fixed, required costs (such as mortgage, insurance, TV/internet/cell phone, groceries) and fun costs. Differentiate the ‘must haves’ from the ‘like to haves’ and consider when or if you will reduce these expenses — think housekeeper/gardeners, your morning Starbucks coffee, and gym memberships.

Remember that having an emergency fund is a good idea even when the economy is on a strong footing. If reaching the dollar amount that you need for three months of reserve is intimidating, start by saving a little bit at a time and auto-contributing each month. Also check to see what the interest rate is on your savings account and consider if you could be getting more interest elsewhere (for instance, online banks tend to have higher interest rates than brick and mortar banks).

2. Check your spending

It’s a good idea to stay on top of your spending habits. Are you spending more than you thought? Mindless spending can add up quickly. Consider canceling underutilized subscriptions and/or adding barriers to your online spending (for example, remove saved credit cards that make it easier to hit “purchase”).

3. Check your debt

It’s always the right time to conquer that outstanding debt! Aim to create a payment plan to remove any debt and try not to add any extra debt to your current financial situation. If you have a high-interest credit card, consider moving the debt to a card with a 0% APR offer on balance transfers. While this generally requires good credit and a balance transfer fee, it could save you a bundle in interest charges.

4. Maintain your automatic savings and investments

The psychology during a recession may make it feel counterintuitive to be investing, especially if the “market” sees large declines. However, especially for financial goals that have a long-time horizon, a market decline allows investors to buy securities “on sale.” For any investment account, make sure you are comfortable and knowledgeable with the level of risk you have and what your risk tolerance is. While market declines are never fun, they are a reality of investing. The goal should be to have an investment plan that you are comfortable sticking with when times are “bad,” as well as when times are “good.”

5. Analyze your occupational skill set

Review your skill set and consider potential ways to diversify your income stream. Are there any opportunities to take on new responsibilities at work? Or to learn a new skill that will help make you more indispensable? Do you have a hobby that could be a side hustle? Even in an upward trending market, “investing in yourself” and building out your skill set is a great way to enhance your career growth; in a downward trending market, it could also help you keep your job.

With additional time at home and away from your favorite hobbies, we have found it to be a great time to learn something new or take that class that you’ve been putting off for some time. Many universities are offering online learning courses and there are numerous free online resources to explore as well! Check out: Coursera, Udemy, and LinkedIn Learning.

Investing for the long term, and enjoying the ride

The daily market swings can produce anxiety in even the most hardened investors. But it’s important to control your emotions, as difficult as it may be. While it may feel counterintuitive, staying the course and fighting the urge to react will pay off in the long run.

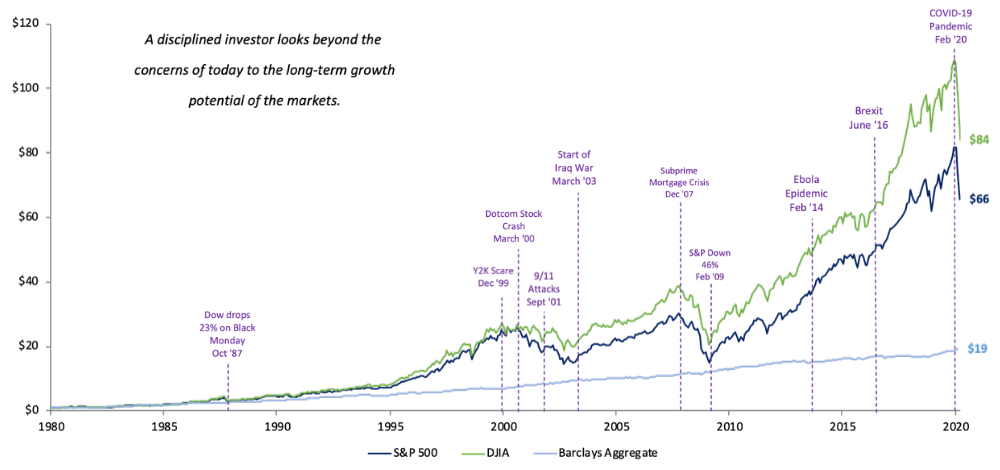

This is also where historical perspective can be helpful. While the steps the government has taken to mitigate the widespread impact of COVID-19 are unprecedented, market pullbacks and recessions are not. Different exogenous events have impacted the market over the last century — everything from oil crises, to Y2K fears, to other viruses — and each time, the economy has recovered and the market has continued to climb. The chart below shows the growth of $1, despite various “crises,” if it had been invested in the Dow Jones Industrial Average (DJIA), the S&P 500, or the Barclays Aggregate Indices over the past 40 years.

Markets Have Rewarded Discipline

Growth of a dollar – 1980 to Q1 2020

Source: Bloomberg. S&P 500 uses ticker “SPX Index”, DJIA uses ticker “INDU Index”, and the Barclays Aggregate uses ticker “LBUSTRUU Index.” Data as of 3/31/2020.

Over and over again, we have seen that trying to time the market’s highs and lows is impossible to do with any consistency. The market has a way of digesting bad (and good) news quicker than any individual, and in the past, it has bottomed and recovered well before the bad (or good) news headlines have stopped. Research has shown that one, three, and five-year annualized returns after a big market decline often reward patient investors with large gains.

If you would like to talk to a financial advisor about tips to help you stay the course, or if you have any questions about your investment strategy during this uncertain time, please contact our team.

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.