Ladies, Do You Feel Secure About Social Security?

- April 6, 2022

Share this article

As a growing wave of Americans sit on the cusp of retirement, questions and concerns about Social Security are plentiful, particularly for women. As we shared in a previous blog, women tend to live longer and earn less than men, making them more likely to outlive their savings. For many, Social Security benefits make up the core of their retirement income, meaning that it’s especially critical to think ahead and come up with a strategy tailored to them and their unique circumstances. Here, we break down Social Security, from the basics to some of the complexities, to help you ensure that you claim the maximum amount to which you’re entitled.

Back to the Basics

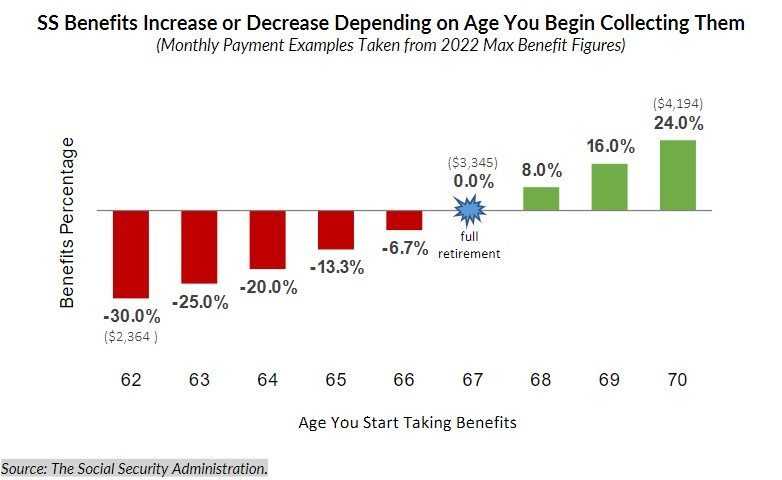

Depending on the year you were born, your eligibility for Social Security and your full retirement age will differ. For example, for those born before 1937, the full retirement age is 65, while for those born in 1960 or later, the full retirement age is 67. While individuals may collect benefits prior to reaching full retirement age, it means a permanent reduction in payments. On the other hand, if one waits until full retirement age to claim benefits, they will receive 100% of their earned benefits. Furthermore, waiting beyond full retirement age has an added bonus; the amount you receive in monthly social security payment goes up by 8% every year you wait to claim until age 70. However, there is no benefit to waiting longer than age 70 to claim.

Social Security eligibility is measured in “work credits,” and to qualify for benefits in retirement, you must earn at least 40 credits throughout your career. Based on your annual earnings, you can earn as many as four credits each year, so it takes a minimum of 10 years of work to qualify for Social Security. Keep in mind that the amount of earnings required for a work credit increases each year alongside general wages and that the years counted do not need to be consecutive or full time. In 2021, an employee needed to earn $1,470 to get one Social Security work credit and $5,880 to get four.

Each year since 1975, the government has adjusted Social Security benefits based on inflation. This cost-of-living adjustment (COLA) is very valuable, as it’s the equivalent of buying inflation protection on a private annuity. The latest COLA, determined in October of 2021, was 5.9%, the largest adjustment since 1982.

So, how are your Social Security benefits calculated? The maximum of each individual’s benefits is based on the 35 calendar years in which their income was the highest over the course of their career, capped at a certain point. There is a wide range of benefits depending on the amount of time worked during your career as well as the amount earned. While the Social Security Administration can’t say for certain what your actual benefit amount will be until you apply for benefits, their Retirement Estimator calculates an estimate for you based on your actual Social Security earnings record. It’s important to note that the estimated and actual amounts may differ due to several factors, including future increases or decreases in your earnings, changes to U.S. laws and policies, COLA, and more.

Special Considerations

• If You’re Married: If you and your spouse have each worked and earned enough credits to qualify for Social Security individually, you will each get your own benefit. For example, if you are due a Social Security benefit of $1,400 per month and your spouse is due a Social Security benefit of $1,100 per month, the two of you will get $2,500 per month.

Being married also opens up several ways to maximize your Social Security income as a couple, making it extremely important to coordinate on a strategy. Be sure to consider benefit estimates for both you and your spouse, your ages and life expectancies, current pension plans, your health insurance, your tax strategy, etc. Don’t forget to consult a professional to ensure that your strategy is sound.

• If You’re Divorced: Did you know that if you’re divorced, you may be able to claim a portion of your ex’s Social Security benefit? To qualify, you must be at least 62 years old, divorced for at least two years from a 10+ year marriage, your ex-spouse must be eligible to begin collecting benefits, and the spousal benefit must be greater than what you would receive based on your own work history. Regardless of whether your ex is currently collecting Social Security benefits or is remarried, you’re still eligible to receive a portion of their benefits.

• If You’re Widowed: If you’re at least 60 years old (50 years old if you’re disabled) and your spouse or former spouse dies, you may be entitled to a survivor’s benefit. To claim a survivor’s benefit, you must be either unmarried or remarried after age 60. Additionally, if you are raising children of your deceased spouse who are under the age of 16, you are entitled to collect survivor benefits at any time, regardless of your age. If the children are unmarried and still in high school, they will also receive benefits in their own names while they are between the ages of 16 and 19.

Social Security and Taxes

Benefits lost their tax-free status in 1984, meaning that many Americans end up having to pay taxes on their Social Security income. The SSA reports that about 40% of those who receive Social Security have to pay income taxes on their benefits. Among those who end up having to pay taxes on up to 50% of their Social Security benefits are those who file federal tax returns as individuals with a total income of more than $25,000, as well as those who file jointly with a total income of more than $32,000. If an individual’s income is more than $34,000 or a married couple’s combined income is more than $44,000, up to 85% of their benefits may be taxable.

Build Your Social Security Strategy with Treehouse Wealth Advisors

Social Security can be quite complex, but it’s extremely important to stay on top of it. After all, something as seemingly small as deciding when to take your benefit could be the difference between a comfortable retirement and outliving your money.

At Treehouse Wealth Advisors, we’re privy to the unique financial challenges faced by women. Our comprehensive financial plans are tailored to each unique clients’ needs. Are you wondering when to start claiming Social Security benefits? Are you unsure about how to maximize your benefits for you and your spouse? Our team can help steer you in the right direction as you prepare for your next big adventure: Retirement.

Reach out today.

Subscribe To Our Newsletter

Sources:

• https://wiserwomen.org/resources/social-security-resources/social-security-what-every-woman-needs-to-know/

• https://www.ssa.gov/pubs/EN-05-10044.pdf

• https://www.ssa.gov/pubs/EN-05-10127.pdf

• https://www.kiplinger.com/retirement/social-security

• https://www.ml.com/articles/social-security-for-women.html

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.