Managing Your Family’s Health Care Costs

- October 12, 2022

Share this article

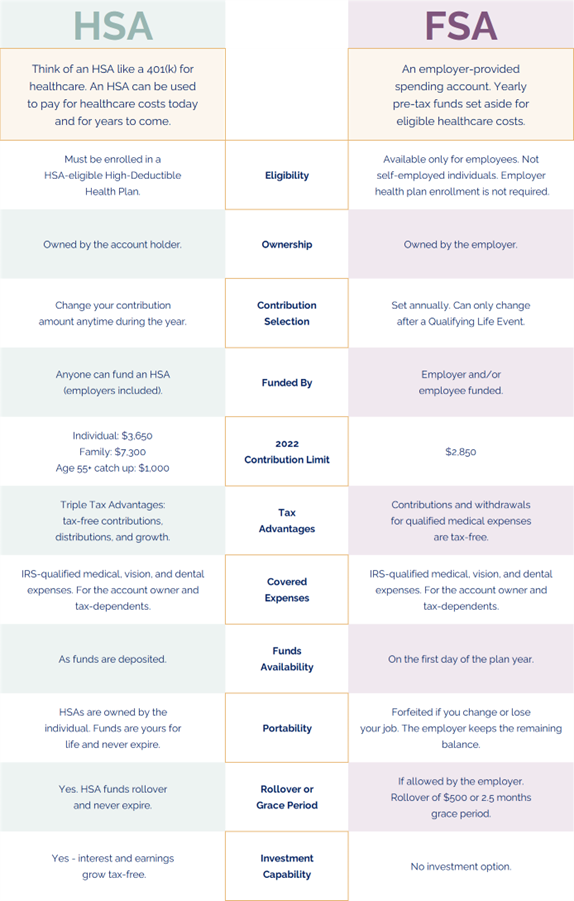

With open enrollment coming up, many of us will be deciding if we want to change our health insurance plans. There are many factors to consider including the opportunity to participate in a Health Savings Account or Flexible Spending Account, options which are often overlooked when making a health insurance plan decision. A family of four in America averaged premiums and deductibles of about $25,000 in 2020. That doesn’t include out-of-pocket medical expenses, and that number is only going up. Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are two options that can help prepare for and offset the cost of medical expenses. But what’s the difference between these two accounts and how do you choose which one is right for you?

An HSA, or Health Savings Account, is a tax-advantaged savings account that can be used to cover medical expenses. Contributions to an HSA are made with pretax dollars, and withdrawals from the account are tax-free as long as they are used to pay for qualified medical expenses. Are there limits to the amount of funds you contribute to an HSA? Yes, there are. For 2022, the contribution limit for an individual with self-only coverage is $3,650. If you have family coverage, the contribution limit is $7,300.

An FSA, or Flexible Spending Account, is another type of tax-advantaged account that is provided by some employers can be used to pay for medical expenses. With an FSA, you can contribute pretax dollars to an account (up to $2850 in 2022) that you can then use to pay for eligible medical expenses.

So, what are the pros and cons of these two types of accounts? And which one is right for you?

Let’s take a look starting with this quick reference guide.

The Tax Advantage

An HSA offers a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free if used for qualified medical expenses. An FSA also offers a tax advantage: contributions are made with pretax dollars, which reduces your taxable income. With an HSA, you only get the tax benefit if you use the money for qualified medical expenses. With an FSA, you never have to pay taxes on the money in the account.

Covered Expenses

Another big advantage of an HSA is that the funds in the account can be used to cover a wider range of medical expenses like dental and vision care, prescription drugs, and even long-term care insurance premiums. With an FSA, on the other hand, the funds can only be used to cover eligible medical expenses like co-pays, deductibles, and certain prescription drugs. Providers like Optum can help you decipher allowable costs.

Growth Opportunities

HSA funds in the account can also be invested, which means they have the potential to grow over time. It doesn’t have the use it or lose it rules associated with many FSA(s). But if you withdraw HSA funds for non-allowed expenses, you must pay taxes on withdrawals from the account. You may also have to pay a penalty on top of paying taxes if you withdraw funds from your HSA before you turn 65. With an FSA, the funds are used as they are contributed and there is no opportunity for them to grow. Some employers allow a percentage of these funds a maximum of $570 to rollover into the following year but each employer sponsored plan can have specific guidelines so you should talk to an HR professional at your organization.

More Rules

One caveat with an HSA is that you can only contribute to the account if you have a high-deductible health plan. For 2022, the minimum deductible for a high-deductible health plan is $1,400 for an individual and $2,800 for a family. If you don’t have a high-deductible health plan, then you’re not eligible to open an HSA. FSAs are only available to all who have a traditional health insurance plan. A traditional health insurance plan is a type of health insurance that is typically provided by an employer. The premiums are usually paid by the employer, and the coverage is typically more comprehensive than what is offered by a high-deductible health plan.

So, which is better? An HSA or an FSA? It really depends on your circumstances. Your need for medical care should also be a consideration when determining the best solutions for you. If you are healthy and don’t anticipate needing much medical care, then an HSA might be the better choice. If you have a chronic illness or expect to have high medical bills, then an FSA might be the better choice. At Treehouse Wealth, we build a multitude of financial planning strategies to ensure you are making the best decisions for yourself and your family. Ask us how.

Subscribe To Our Newsletter

Sources:

- ACA Index Report on Unsubsidized Consumers in the 2020 Open Enrollment Period June 2020

- IRS Announces 2022 Limits for HSAs and High-Deductible Health Plans

- https://livelyme.com/blog/differences-between-hsa-vs-healthcare-fsa-infographic/

- https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2022-fsa-contribution-cap-and-other-colas.aspx

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.