Q1 2025 In Review

- April 16, 2025

Share this article

After a relatively strong January to start 2025, U.S. equity markets retreated through the remainder of the first quarter, led by a notable pullback in technology stocks. For the quarter, the S&P 500 declined 4.27%, while the Nasdaq Composite, more concentrated in tech, dropped 10.26%. However, those figures don’t capture the full picture. The Dow Jones Industrial Average proved more resilient, slipping just 0.87%. Fixed income provided a bright spot, with the Bloomberg U.S. Aggregate Bond Index gaining 2.78%.

A Quarter of Contrasts

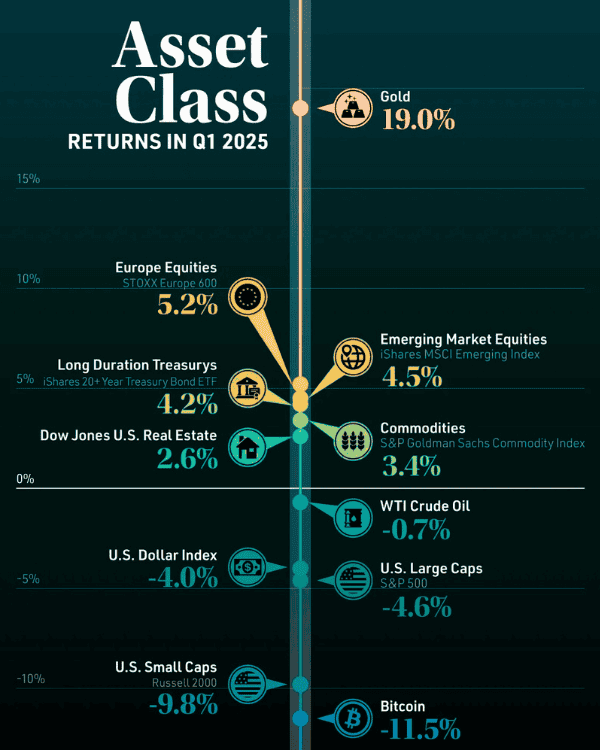

Source: Voronoi, Markets, Gold Was the Top Performing Asset in Q1

The year began with a sharp divergence in asset class performance and a flurry of headlines that reminded investors just how quickly sentiment can shift. Q1 served as both a case study in market unpredictability and a clear reminder of the importance of diversification. Gold led the way with a 19.0% gain, followed by European equities (+5.2%) and emerging markets (+4.5%), buoyed by attractive valuations and signs of stabilizing global growth. In contrast, U.S. equities faced headwinds: the S&P 500 declined over 4%, while small caps fell almost 10%, reflecting their heightened sensitivity to economic and policy uncertainty.

On the fixed income side, bonds reasserted their value as portfolio diversifiers after several years of moving in lockstep with equities. Long-duration Treasurys returned 4.2%, benefiting from falling yields in March as geopolitical risks intensified and investors rotated toward quality. The Bloomberg U.S. Aggregate Bond Index, a broad measure of investment-grade bonds, also delivered a positive return of 2.78% for the quarter. This wide dispersion of returns underscores a key investing principle: even when headlines seem singularly focused, markets often move in many directions beneath the surface.

Source: JP Morgan Market Insights, Guide to the Market Q1 2025

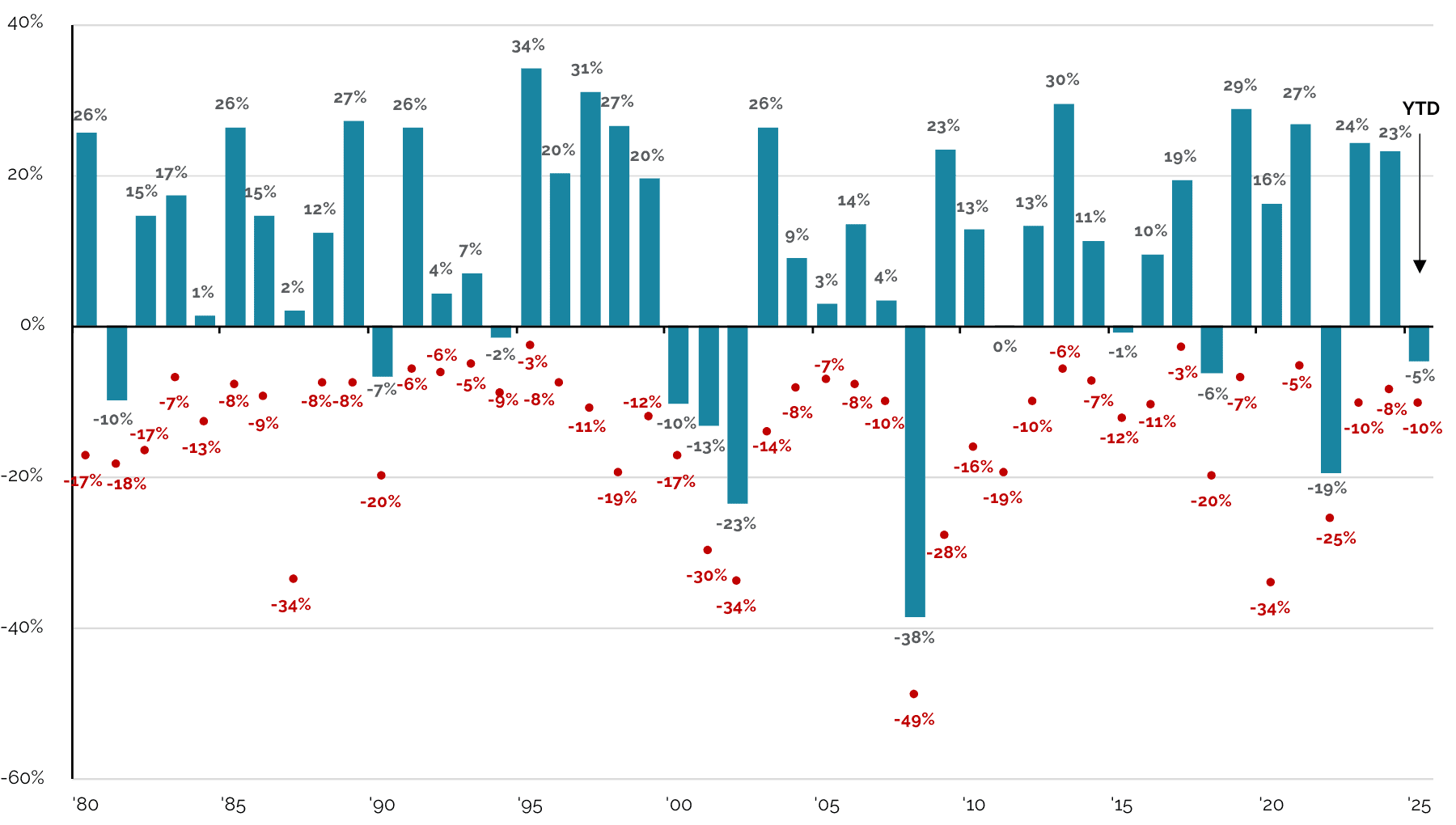

Despite the flurry of volatility throughout the quarter, Q1 offered two important reminders for long-term investors. First, diversification remains one of the most effective defenses against market unpredictability. While headlines may have been turbulent, several asset classes posted positive returns—and notably, seven of the eleven S&P 500 sectors also ended the quarter in positive territory¹.

Second, for those who didn’t follow markets day-to-day and simply compared their portfolio values on January 1st and March 31st, the quarter might not have felt like so much of a roller coaster. This highlights a timeless investing truth: one of the biggest mistakes investors can make is overreacting to short-term noise. For context, Q1 included a peak-to-trough drawdown of approximately 10%. Historically, the average intra-year decline in the S&P 500 is closer to 14%, and despite these swings, annual returns have been positive in 34 of the past 45 years². Market corrections—defined as drops of 10% or more—occur roughly every two years, while bear markets (declines of 20% or more) happen about once every six years³. In short, volatility isn’t the exception—it’s the norm.

Politics, Policy, and the “Liberation Day” Tariffs

So far, much of this year’s market narrative has centered around the return of the Trump administration and the swift policy shifts that have followed. In the first few months of President Trump’s second term, the administration has aggressively reoriented the U.S. trade agenda, scaled back environmental regulations, reopened federal oil and gas leasing, proposed revisions to immigration and corporate tax policy and used executive orders to attempt to deliver on campaign promises and reverse policies from previous administrations4. While various policies have impacted individual sectors and companies differently, what’s stood out to investors is not just the pace of these changes—but the unpredictability of the administration’s direction. In some cases, the White House has announced bold measures only to walk them back or revise them days later—for example, floating delays in tariff enforcement or signaling interest in bilateral trade talks shortly after imposing sweeping trade barriers5. These quick pivots, while politically strategic, have added to market whiplash and made it more difficult for investors to assess long-term implications.

Recently, trade policy again took center stage with the announcement of the “Liberation Day” tariffs on April 2. While the announcement was technically made in Q2, uncertainty about the proposal was being felt throughout markets through much of Q1. Since the announcement, markets have reacted quickly, declining sharply on fears of a global trade war, a renewed protectionist stance, and concerns that these tariffs could either stall the economy or prolong inflation6.

While the long-term effects of “Liberation Day” are yet to be seen, 2025 has already shown that political headlines can cause short-term dislocations. History has shown that markets have weathered wars, elections, pandemics, and sweeping policy shifts. Over the long term, US markets have recovered and rewarded investors. What matters most is staying focused on what we can control: maintaining a disciplined, diversified, and long-term investment strategy. Past performance never guarantees futures results. Volatility is not something that can always be avoided. In fact, hard as it can be, some of the best opportunities are found within that volatility!

In times like these, we’re reminded why long-term investing remains the most reliable path to building and preserving wealth. Attempting to time the market—especially during politically charged or uncertain periods—can often do more harm than good. A well-diversified portfolio, thoughtfully balanced across asset classes, geographies, and risk factors, provides resilience through market cycles and uncertainty alike.

As always, we welcome the opportunity to connect. If you’d like to review your portfolio, revisit your financial plan, or simply have a conversation about what’s ahead, please don’t hesitate to reach out. We’re here to support you every step of the way.

—Your TWA Team

Sources:

- FT Portfolios Economic Research

- JP Morgan Market Insights, Guide to the Market Q1 2025

- Reuters: S&P 500 correction in six charts 03.15.2025

- Wall Street Journal: The Trump Tracker: 54 Notable Moves in 80 Days 04.09.2025

- Associated Press: Sweeping Trump tariffs shock global economy, drawing threats and calls for talks 04.03.2025

- Wall Street Journal: Trump Tariff News, April 3, 2025: Tariffs Send Dow to 1600-Point Decline, Dollar Slumps 04.04.2025

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.