Q2 2025 In Review

- July 23, 2025

Share this article

By Stacey Chin, CFP®, ChFC®

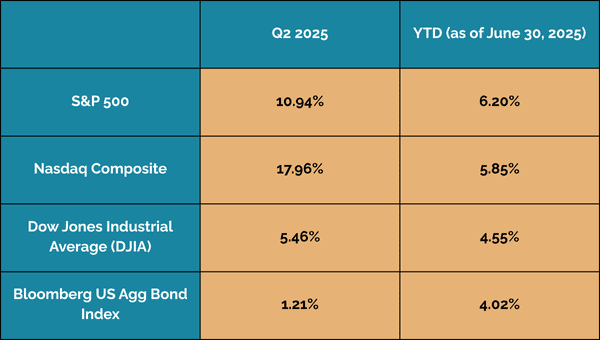

Q2 2025 was quite the roller coaster for the financial markets! After a bruising April that saw the S&P 500 drop 10.2%, the worst monthly performance since March 2020, investors who stayed the course were rewarded handsomely. By quarter-end, all major indices had not only recovered but posted impressive gains. The chart below shows the returns for major indices for the second quarter versus year-to-date:

Liberation Day and Market Jitters

This quarter may be remembered for “Liberation Day”, April 2, when President Trump proposed sweeping new tariffs on imported goods. The suggested 10% blanket tariff triggered an immediate market reaction, with the S&P 500 plunging 4.8% the following day — its worst single-day drop since the early days of the Covid pandemic in 2020.1

Fortunately for most investors, a week later, the administration decided to implement a 90-day review period, which helped calm nerves. Investors who resisted the urge to sell amid the panic were rewarded with a strong rally from April lows through June 30. While the “pause” in tariff implementation sparked the rally, the dramatic turnaround can also be attributed to a mix of better-than-feared Q1 earnings, resilient consumer spending, and a cooling labor market that has increased hopes for a Fed rate cut later this year.2 Despite the lack of a clear resolution on the tariff policy, it seems that markets have grown less reactive in recent weeks, a reminder that uncertainty alone isn’t always a trigger for lasting volatility. This quarter is a textbook case of why staying invested, even during scary headlines, matters. Volatility is part of the ride, and sometimes the sharpest rebounds come right after the scariest headlines.

A Case for Going Global

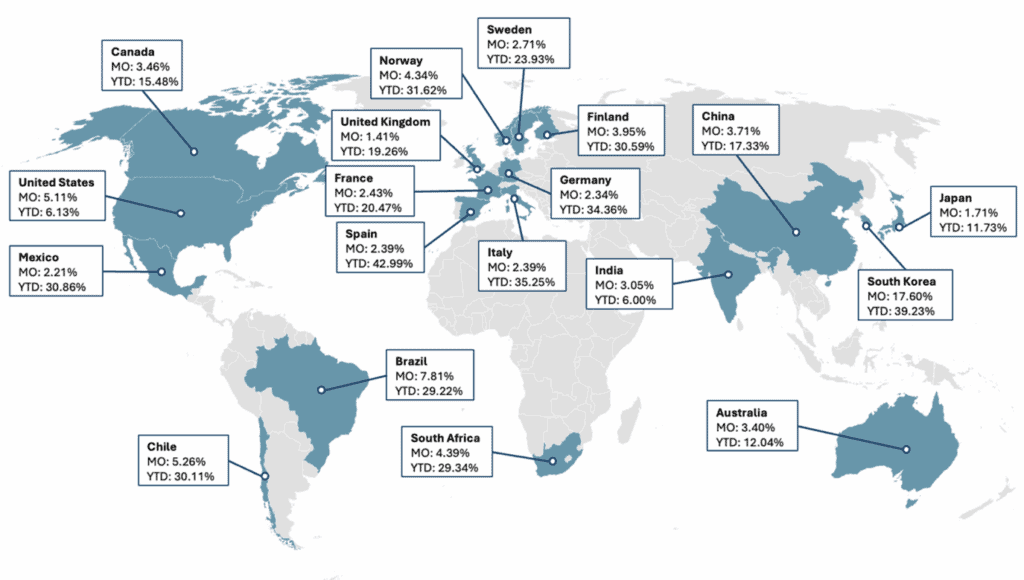

For the past few years, U.S. markets have been the star of the show. However, Q2 2025 highlighted the value of keeping a global perspective. While US markets stumbled in April, European equities held firm with the MSCI Europe index returning a positive 1.7% compared to the S&P 500’s -10.2%. This is part of a continuing trend. YTD through mid-May the MSCI Europe Index gained 17.3% in gross USD terms, far outpacing the -3.5% return of the MSCI USA Index. Currency movements, primarily due to the depreciation of the US Dollar, accounted for roughly half of Europe’s outperformance.3

Equity Returns by Country (as of 6/30/2025)

Source: Avantis Investors, Monthly ETF Field Gude

A stronger Euro, relative to the US dollar has also grabbed the headlines. In 2025, the Euro has continued to show strength, gaining around 14% against the US Dollar and hitting its highest level since early 2023. Especially in the shorter term, a weaker dollar may benefit U.S.-based investors with international holdings. Foreign returns translate into more dollars, as we’ve seen with international stock returns this year. That said, currency strength can be a double-edged sword. A stronger Euro may eventually weigh on European company earnings by making exports more expensive and less competitive globally.4 Still, in the near term, global diversification has once again proved its worth.

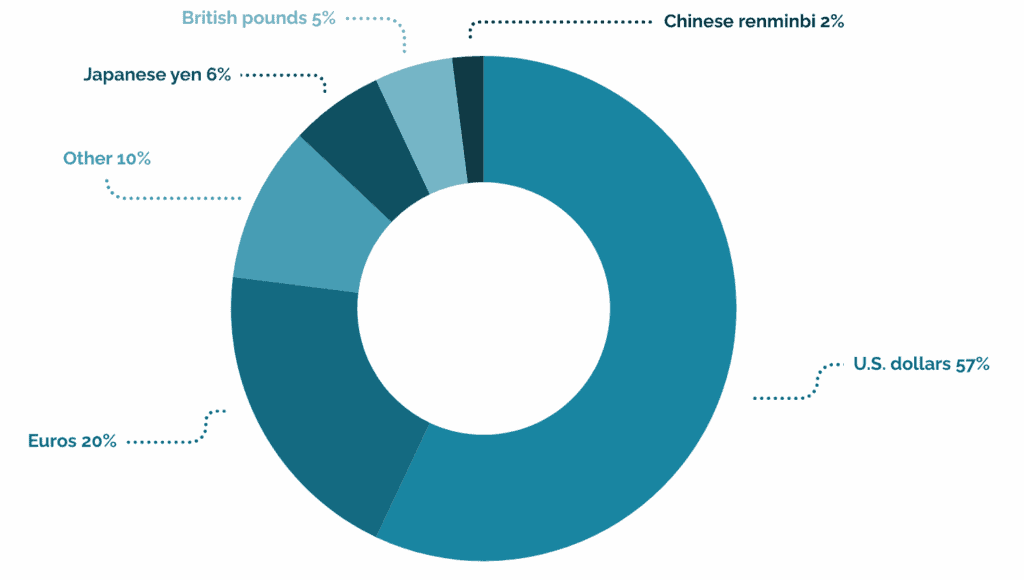

The World’s Reserve Currency

The recent weakness in the dollar also sparked renewed discussion around its role as the world’s reserve currency, but what does that really mean?

Essentially, the U.S. dollar’s status as the world’s primary reserve currency means it is the dominant currency held by global central banks and used in international trade, commodities pricing, and financial transactions. The US dollar has been the world’s reserve currency for about 80 years, since the 1944 Bretton Woods agreement. At its peak, 73% of the global currency reserves were in dollars. Today, the dollar makes up roughly 58% of global foreign exchange reserves, and while that’s far from its peak, it’s also not its low. In both the 1960s and the 1980s, it was at 50%. Today’s 58% is also still far more than the next closest, the Euro, at 20.1%.5,6

The dollar dominates global foreign exchange reserves

Note: Share of global allocated foreign exchange reserves as of the third quarter of 2024

Source: IMF|L.Proud|March27,2025

This dominance reflects trust in the depth, liquidity, and perceived stability of U.S. financial markets and institutions. While there is growing chatter about the dollar losing ground, driven by geopolitical shifts, bilateral trade in other currencies, and rising use of the Euro or Chinese yuan, structural change would likely take decades, not months. For U.S. investors, the dollar’s central role helps keep borrowing costs low, supports global demand for U.S. assets, and provides stability during periods of global uncertainty.

An Icon Steps Back

Finally, Q2 marked a bittersweet moment for the investment world: Warren Buffett’s official step-down from day-to-day operations at Berkshire Hathaway. While he remains as Chairman Emeritus, responsibility now formally transitions to Greg Abel, long seen as Buffett’s successor.

Buffett’s investment philosophy — stay disciplined, ignore the noise, think long term — is more relevant than ever. One of his most beloved quotes comes to mind:

“Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Our mission remains helping you plant those trees thoughtfully and patiently, so you can enjoy their shade tomorrow.

As always, if you have any questions about your portfolio or the markets, or just want to chat, please don’t hesitate to reach out.

All the best,

The TWA Team

Sources:

- https://apnews.com/article/stocks-markets-rates-tariffs-52dbb020a4c41122e31669c2da236d67

- https://www.reuters.com/business/investors-put-liberation-day-lessons-work-scarred-by-tariff-tumult-2025-07-08/

- https://www.msci.com/research-and-insights/blog-post/some-see-a-renaissance-for-european-equities

- https://www.ft.com/content/87683620-c9c9-4ec4-9584-0fb98d313418

- https://www.reuters.com/business/finance/challenge-dollar-supremacy-long-way-off-central-bankers-say-2025-07-01/

- https://www.profgmarkets.com/p/dollar-hits-3-year-low-what-happens-next?utm_source=www.profgmarkets.com&utm_medium=newsletter&utm_campaign=dollar-hits-3-year-low-what-happens-next

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.