Q3 2025 In Review

- October 20, 2025

Share this article

By Stacey Chin, CFP®, ChFC®

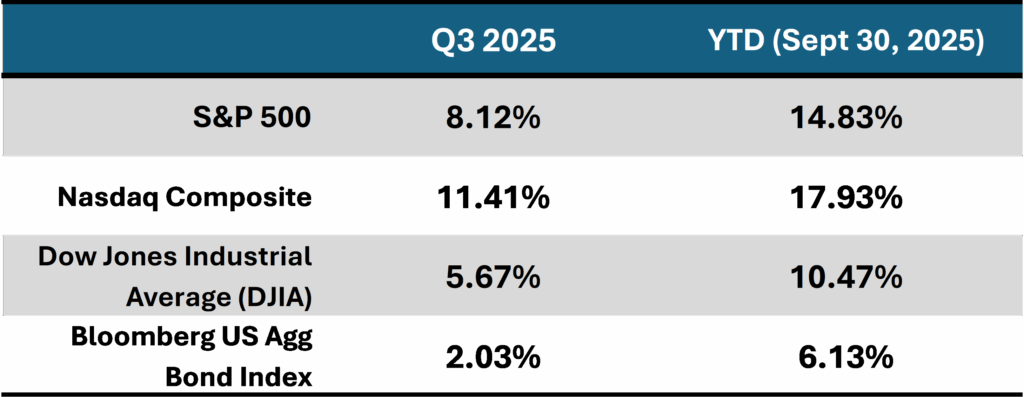

What a summer for US markets! Building on the end of Q2’s impressive gains, US markets continued to post strong returns. From May through September, US stocks turned in their second best summer since 1950. The returns weren’t limited just to US stocks, either. International equities, high quality bonds, and even cash had strong positive returns. In plain English: staying diversified worked. The chart below shows the returns for major US indices for the third quarter versus year-to-date:

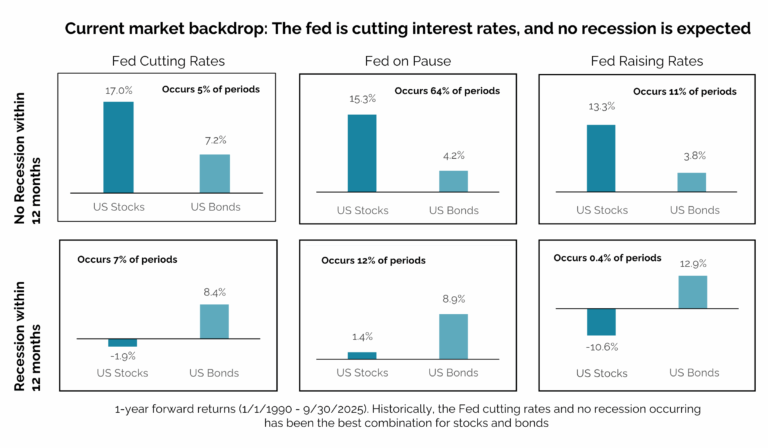

As seen in the graphic above, when the economy avoids a recession, U.S. stocks have posted double digit gains the following years. When the Fed starts cutting rates and a recession is avoided, U.S. stocks have posted an average gain of 17% in the year following the first cut.2 While only time will tell what the future has in store for us, market performance in Q3 seems to indicate that that market is not expecting a recession in the near term. Remember that recessions are generally considered backward looking indicators and they’re often not officially declared until they’re well under way.

As has been the story for the last few quarters, AI continues to dominate headlines. By the end of Q3, the value of “Magnificent 7” was about a third (34%-36%) of the S&P 500’s value. Rising stock prices and valuations combined with concerns about unrealistic expectations have fueled questions about an AI bubble. Companies are spending tens of billions of dollars on AI, but it’s hard to measure the exact return on those investments. In part this is because a meaningful share of employees still use AI “under the radar,” complicating productivity measurements and governance. Prominent pundits disagree if we’re in an AI bubble and if we are, how far reaching it would be if that bubble popped. Some warn of froth and correction risk, while others argue today’s advance rests more on earnings power than on 1999-style speculation. Unlike prior bubbles, the AI hype is focused on relatively few (public) companies. Valuation-wise, the S&P 500 forward price to earnings multiple (PE) sits around 23, which is above its 5-yr average of 20.3. Several megacaps trade in the mid-20s to low-30s on forward earnings – with Tesla an outlier far above that range – levels notably below the triple-digit forward multiples seen in parts of the dot-com era (e.g., Cisco near or above 100x at the peak).3 As always, we suggest keeping a diversified portfolio and keeping disciplined to avoid undo concentration risk.

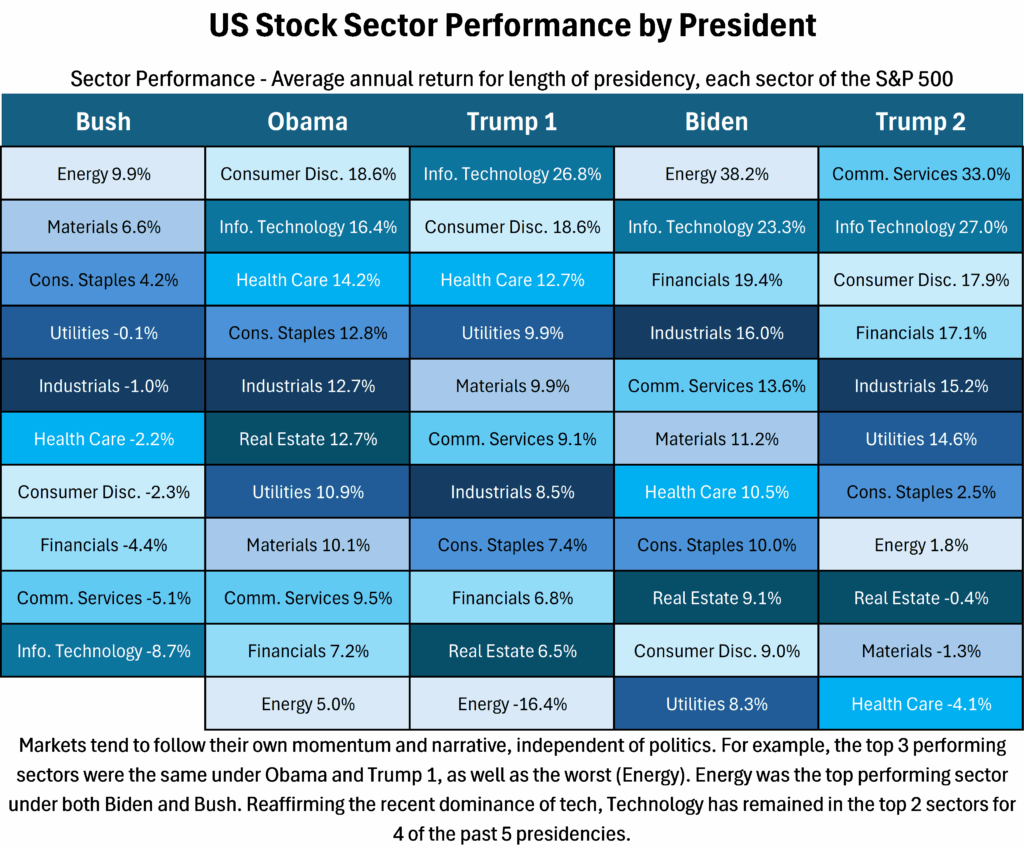

Politics continue to dominate the airwaves and it’s next-to-impossible not to be emotionally impacted. However, it’s also good to remember that markets tend to march to their own rhythm rather than political narratives. Long-horizon evidence shows only small, statistically insignificant differences in equity returns under Republican vs. Democratic presidents, and a generally upward trend across administrations; a reminder that shareholders own companies, not a party platform.4 Moreover, which sectors outperform is not necessarily tied to who’s in the oval office. It’s one reason to favor discipline in investment portfolios rather than drama. Decades of data show the cost of market-timing mistakes is high; missing even a handful of strong days can materially dent long-term returns. Staying invested has historically captured a much larger share of the market’s compound returns.5 In other words, returns tend to come from time in the market, not timing the market. Of course, past performance is not indicative of future results.

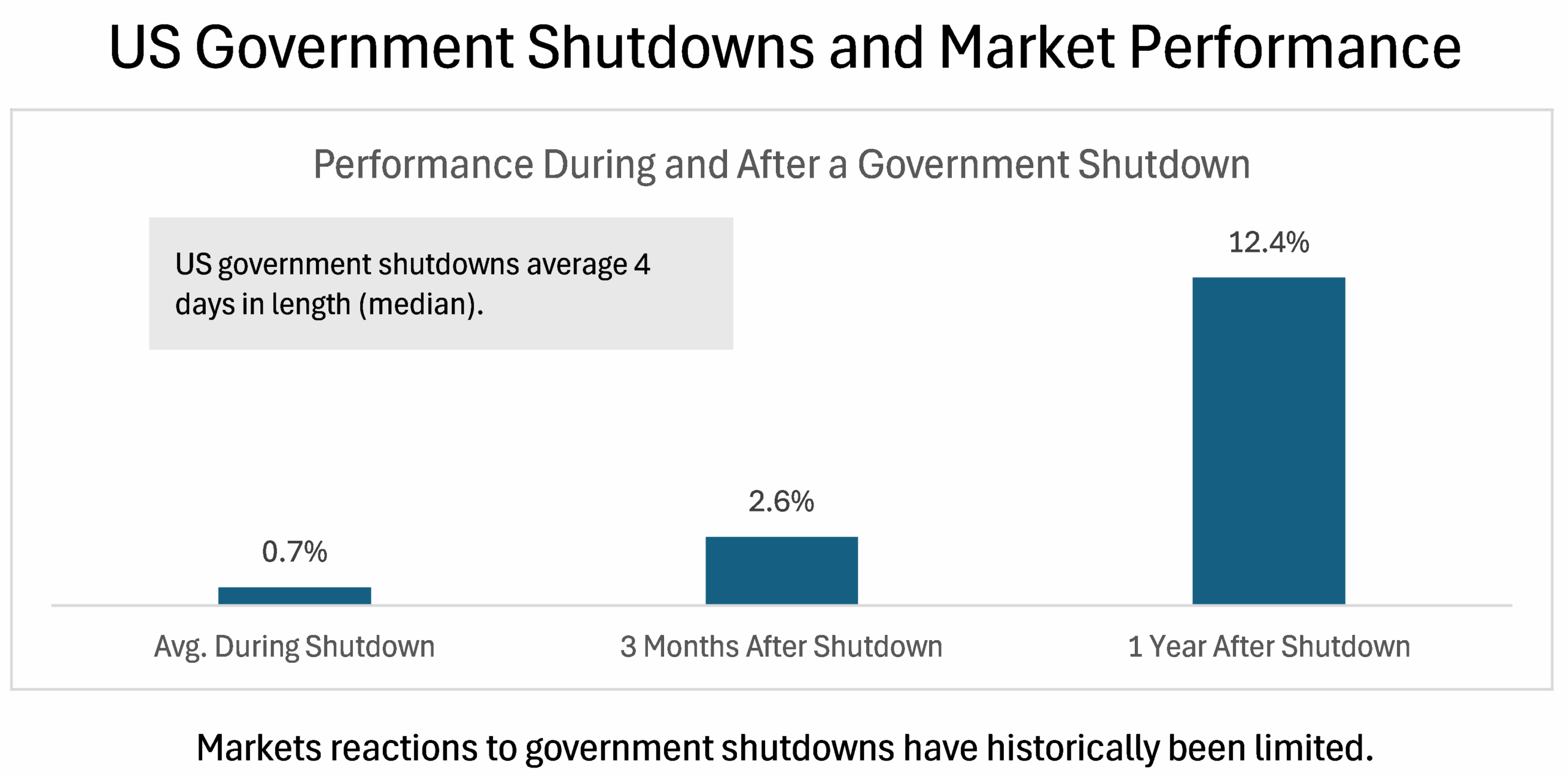

While not strictly a Q3 event, the U.S. government shutdown has been top of mind. Although it officially began on October 1, 2025, the debate and “what-if” questions were building for weeks. From a market perspective, the reaction was muted. The day of the shut down the S&P 500 barely budged; it actually closed slightly up for the day. Since the modern budget process started in 1976 there have been about 20 funding gaps. However, before 1980 the government did not shut down. Since 1981, ten funding gaps of three days or fewer have occurred. Not including the October shutdown, there have been four “true” shutdowns that impacted operations more than one business day.6 Market reactions around these episodes have generally been limited, as investors tend to focus on broader macro trends and earnings rather than short-lived budget standoffs.

Juxtaposed with short-term skirmishes, a more enduring note of reflection feels appropriate. We also mark the recent passing of Dr. Jane Goodall, whose life’s work embodied stewardship, patience, and optimism. Her calm persistence models a steadier compass and reminds us to “never give up”. Many of us read her “Book of Hope” amid the Covid 19 pandemic and her optimism and reminder to stay hopeful, curious, and patient continues to feel fitting as both human beings and investors.

As always, if you have questions or just want to chat, we’re here to help. We always love hearing from you!

—Your TWA Team

Sources:

- 1. https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm

- 2. https://blogs.cfainstitute.org/investor/2025/09/17/when-the-fed-cuts-lessons-from-past-cycles-for-investors/

- 3. https://www.barrons.com/articles/ai-bubble-stocks-goldman-sachs-5afd1448?gaa_at=eafs&gaa_n=ASWzDAgiEj3LutzXf8ZyZE04Euhen8gN6Sli8jq0L7sW-obuPaJIzg_ClIY1iPCywv0%3D&gaa_ts=68ed328f&gaa_sig=l6j-Wmmx10-HuSP6odMZ7Bu5d64kqQIbeey91v0VzCIAyScMPz4FsHqdsLYhy8KGe1WFaonWwI5awEFgpyOTYg%3D%3D

- 4. https://investor.vanguard.com/investor-resources-education/article/presidential-elections-matter-but-not-so-much-when-it-comes-to-your-investments

- 5. https://www.schwab.com/learn/story/does-market-timing-work

- 6. https://www.crfb.org/papers/government-shutdowns-qa-everything-you-should-know

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.