Q4 2024 In Review

- February 6, 2025

Share this article

Looking Back at 2024

2024 saw the US stock market overcoming uncertainty to give investors strong returns. US stocks extended their bull market with the S&P 500 gaining over 20% for its second year in a row (this last occurred in the late 90s) (1). While much of the economic conversation early in the year centered around layoffs, AI, the Federal Reserve, and inflation, the last quarter of 2024 was dominated by the political arena. Despite these questions, equity markets continued to show resilience. For Q4 2024, the S&P returned a positive 2.41% and the Dow Jones hung on to return a positive 0.93%. The tech-heavy Nasdaq finished the year strongly, gaining 6.35% for the quarter. The fixed income markets were negatively impacted by questions about future Federal Reserve policy and the Bloomberg Aggregate Bond Index dropped -3.06%. However, for the year, these indices were all positive with the S&P returning 25.02%, the DIJA 14.99%, the Nasdaq 29.57%, and the Bloomberg Agg gaining 1.25%.

Bulls and Bears

Source: https://www.blackrock.com/us/financial-professionals/insights/student-of-the-market

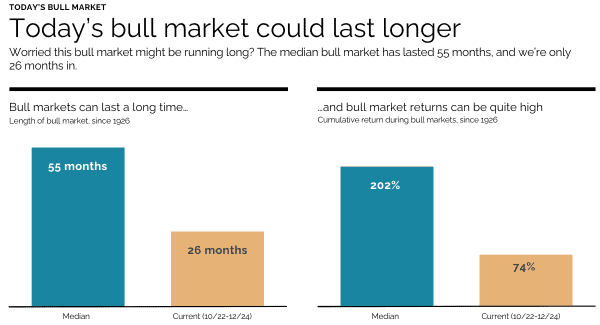

With a 25% return from the S&P 500 last year, it is reasonable to question what the markets have in store for 2025. While no one has a crystal ball, historically, bull (up) markets have lasted longer than bear (down) markets. The median bull market has lasted 55 months, and we are only 26 months in. Past performance does not predict future results and no one can consistently predict when the market will see a pullback. However, this is a good reminder that it is usually “time in the market, rather than timing the market” that has ultimately brought long term investors strong positive returns.

Source: https://www.schwabassetmanagement.com

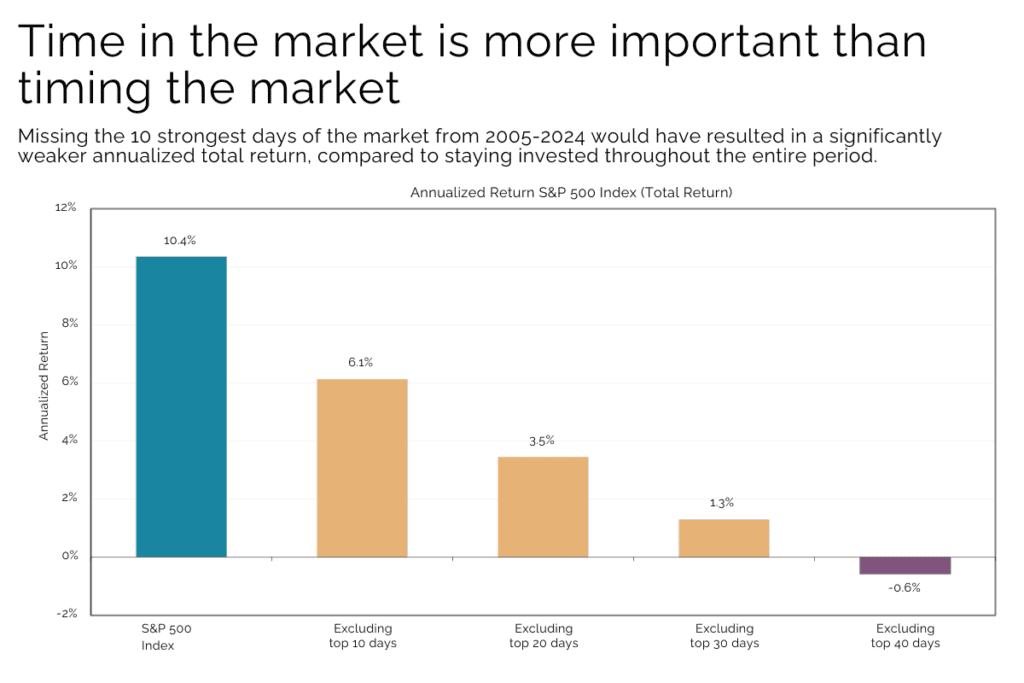

Every year there are moments of uncertainty, and some may feel inclined to “step aside”. 2024 was no exception and 2025 is sure to bring its own questions! For long term investors, stepping aside has historically been an unwise decision for their long-term returns. Missing just the 10 strongest days in the last 20 years would have significantly changed an S&P 500 investor’s returns. Further, many of the “strongest days” occur right after significant volatility.

Let’s Talk Tariffs

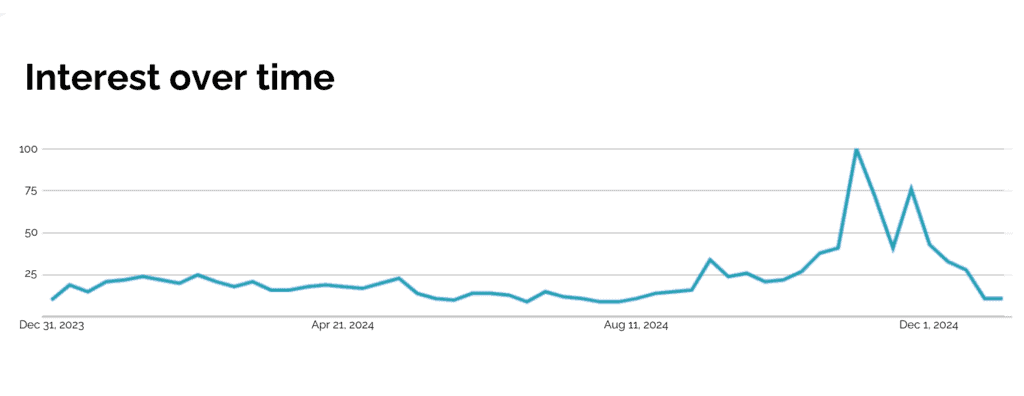

The U.S. presidential election dominated many of the headlines in Q4. Historically, financial markets have performed well under both Democratic and Republican administrations, though individual sectors tend to experience varying outcomes depending on the prevailing political climate. Changes in the White House can feel like a spark to volatility for this reason and, so far, President-elect Donald Trump’s victory in November has followed this pattern. Promises of tax cuts and deregulatory measures have fueled optimism in some areas, while concerns over a potentially unpredictable trade agenda has reignited fears of protectionist policies and their implications for global markets. One topic that has received heightened interest has been tariffs.

Google Search Trend For The Word “Tariff” In 2024

Source: https://trends.google.com/trends

So, what exactly is a tariff? A tariff is a specific type of tax applied to goods crossing international borders. Governments often use tariffs to try to protect domestic industries, generate revenue, gain leverage in trade negotiations, etc. While tariffs are initially paid by importers, they often result in higher prices for consumers. The big idea behind tariffs is to encourage consumers to “buy local”. Historically, tariffs have also sparked trade wars that impact the end consumer. The new tariff proposals have sparked concerns about rising inflation, supply chain disruptions, and reduced global trade volumes.

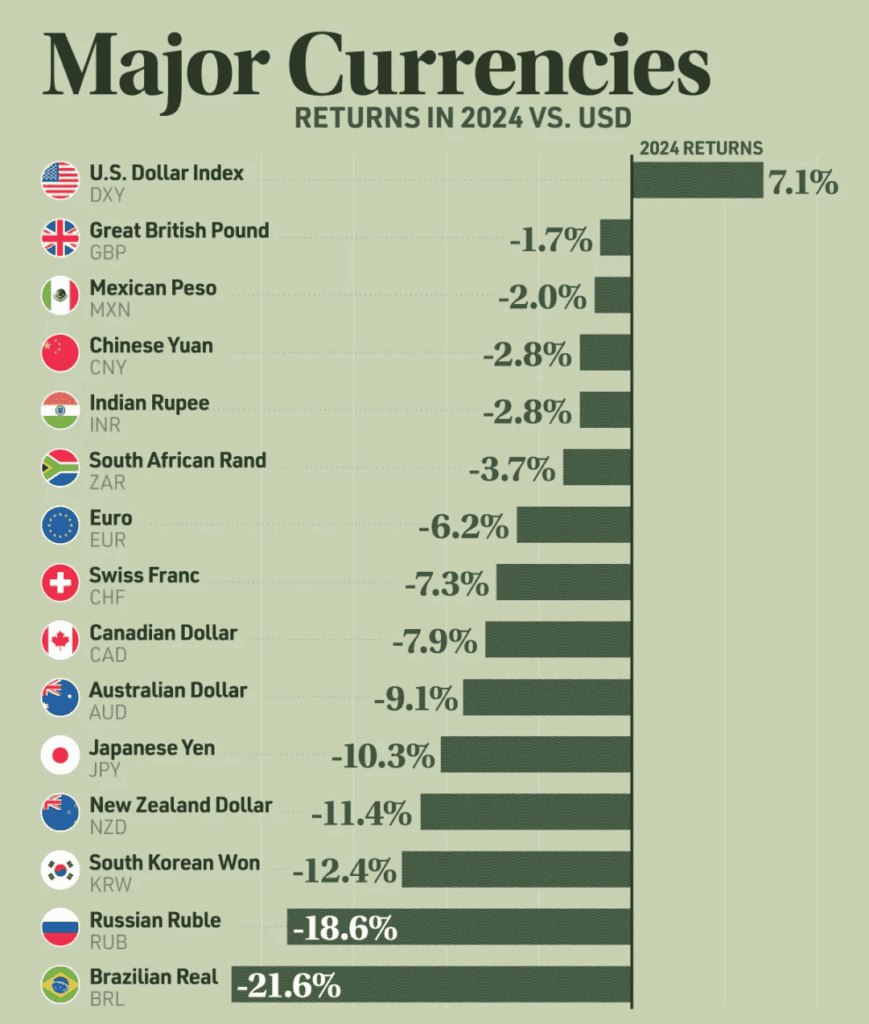

While many economists believe that tariffs could raise prices and reduce economic growth, some believe they are a valid negotiating tactic, and have suggested that President-elect Trump may use them as such (2). Others also suggest that if the US dollar continues to appreciate, it will offset potential price increases for US consumers. Remember that a strong US dollar increases the purchasing power of a US buyer of foreign goods. If the cost of imported goods decreases because of foreign currency weakness, it can offset the effects of tariffs and the US consumer may not feel a price increase.

Source: https://www.visualcapitalist.com/the-us-dollar-against-major-currencies-in-2024/

In 2024, many currencies fell to unexpected lows against the US dollar. Since late September, the dollar has risen 10% and it is now the strongest it has been in more than two years against a basket of G10 currencies (3). This increase has been driven by a combination of safe-haven demand, relatively higher U.S. interest rates, and global trade uncertainties. The strong dollar is helping to offset some inflationary pressures by making imported goods cheaper, even as tariffs (and expected tariffs) push import prices higher.

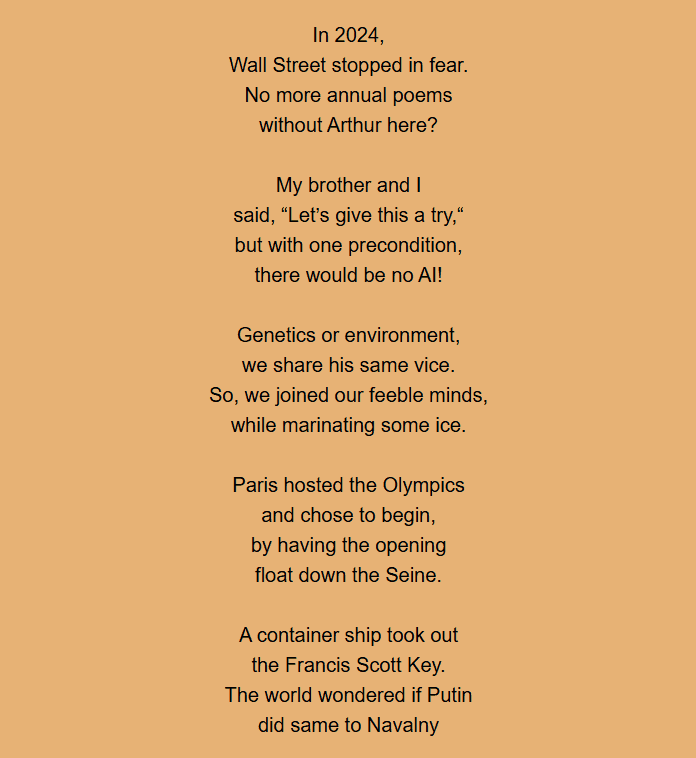

A Farewell to Art

The end of 2024 also saw the loss of a Wall Street legend. Art Cashin, UBS’ director of floor operations at the NYSE and a regular on CNBC for more than 25 years, passed away at the beginning of December. While he may not have been a household name outside of Wall Street, he was a respected figure and his passing leaves a hole that will be difficult to fill. One of Art’s annual traditions was to write a poem reflecting back on the year’s events. While he was unable to write one in 2024, his sons wrote one in homage; for your enjoyment, we’ve included it in the sidebar of this newsletter. The witty verse reminds us of how much happened in 2024 – everything from Paris hosting the Olympics, a container ship wrecking the Francis Scott Key Bridge, to two astronauts being stranded in space. 2024 was an eventful one and we expect nothing less of the upcoming year.

As we start 2025, we wish you the best and, as always, we would love to hear from you. You may have seen that we’ve expanded into San Francisco (read more here). We’re excited about our new teammates and if you find yourself in the City, we would be happy to host you in our new offices.

Sources:

- https://my.dimensional.com/market-review-2024-stocks-overcome-uncertainty-to-notch-another-strong-year

- https://www.csis.org/analysis/trump-trade-20

- https://www.reuters.com/markets/us/dollar-strength-reminds-wall-street-us-exceptionalism-isnt-isolationism-mcgeever-2025-01-14/

- https://www.cnbc.com/2024/12/31/art-cashins-sons-pay-homage-to-nyse-legend-by-carrying-on-new-years-poem-tradition.html

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.