Take Stock of Your Stocks

- April 14, 2021

Share this article

Let’s set the scene. You’ve just been offered a new position and it’s time to negotiate your compensation package. Many growing companies choose to offer equity compensation to incentivize executives and employees to help grow the business. After all, if the company does well and its value increases over time, the more the team’s equity will grow. While stock options can take many forms depending on the maturity of the company you are joining, Incentive Stock Options, Nonqualified Stock Options, and Restricted Stock can typically be found in startup environments. Cash compensation often feels easier to navigate and negotiate, but where does one even start with stock options? And on top of that, what does it all mean for you, for your family, and for your personal financial situation?

Wait, There Are Different Types of Stock Options?

Incentive Stock Options (“ISOs”), or qualified stock options, is a company benefit offered only to employees. ISOs give employees the opportunity to purchase company stock at a discount at some point in the future, typically requiring a vesting and holding period before they can be exercised or sold. ISOs qualify for special tax treatment under the Internal Revenue Code, making any gain from the discount price to the price at the sale considered a capital gain instead of income.

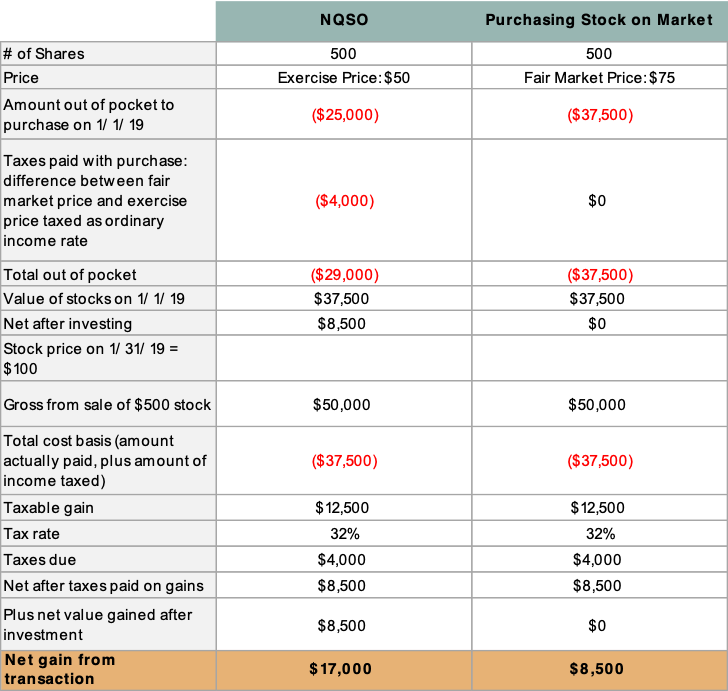

Nonqualified Stock Options (“NQSOs”) are the most common form of stock option that companies grant to their employees, officers, directors, consultants, and contractors. NQSOs operate similarly to ISOs, allowing individuals to buy shares of the company at a preset price, but at a later date, however they do not qualify for any special tax treatment. The difference between the preset price and the price at which the stock trades at the time of exercise is reported as W-2 income, and any sales in the future will incur short- or long-term capital gains taxes with the exercise price acting as the cost basis.

**Okay, so what do I need to know here? In Short: ISOs and NQSOs are pretty much the same thing except NQSOs have less favorable tax treatment. ISOs are less common but more desirable. Let’s break down NQSOs:

Restricted Stock is a whole different beast when it comes to stock options. This form of compensation is typically used in more established companies that provides employees with a share of equity in the company, which only is realized when certain conditions are met, either via time at the company or by hitting a certain achievement milestone. Restricted stock has value at vesting (and is taxed at this point) even if the stock price has not moved or even dropped since grant. You must remain employed until the shares vest to receive the value, however if you leave the company, you will automatically forfeit any unvested restricted stock. This can be a great incentive for employees to remain with the company for a long period of time.

**In Short: If you don’t want to have to purchase your stock options down the line and are willing to wait for the vesting schedule to complete, Restricted Stock is a great option!

Hmm, I Kind of Get It. So, Which One Is the Right One for Me?

As is the case with most financial decisions throughout our lives, this completely depends on our personal situations. Our financial goals, tolerance for risk, investment time horizon, and certain tax implications will all play a role in deciding which stock option is the right option for us. Before starting any negotiations, weigh the pros and cons of each stock option plan and consult a professional to get informed. Speaking to your accountant will give you the best sense of the tax implications associated with each stock option plan.

Incentive Stock Options

ISOs are a great choice for you if you already have saved up enough money for that vacation to Thailand in 2 years and the new house; IE you don’t need additional cash flow in the near future. Typically, ISOs are better for those with a higher risk tolerance and a longer time horizon. If you need that cash for a large purchase coming up, ISOs may not be the best choice for you.

Nonqualified Stock Options

While ISOs are typically a better choice for employees due to the preferred tax implications, NQSOs are a great stock option plan for contract workers, consultants, and certain employees. Additionally, while ISOs can only be transferred upon death of the holder and have strict exercise terms, NQSOs do not have any transfer restrictions or exercise terms (including price).

Restricted Stock

Restricted stock is the best choice for the risk averse investor. If you have a lower tolerance for risk, are approaching retirement age, or need funds for future large purchases coming down the pipeline, this may be the best option for you. Because you will receive shares of the company stock upon vesting, you will be able to use the funds for big-ticket purchases such as college tuition or the down payment on a new home. If you feel that you can’t take on additional risk and volatility, take a deeper look into restricted stock options.

As with all investments, we prefer a diversified approach. If possible, negotiating a combination of stock options may provide a nice balance, with the opportunity for growth as well as security that comes with owning actual shares of company stock. While there are many benefits to company stock options, and you may be biased because you hopefully believe in the company that you work for, it is also important to realize that you could end up with a concentrated portfolio in one company – via both your careers and the stock options that you earn. It’s important to keep the value of your stock options & company stock in check so that it doesn’t become too large a part of your overall portfolio.

Well, I’m still pretty confused….

At the end of the day, nobody knows your financial situation, including your financial goals, as well as you do. Taking the time to stay informed about and involved in your equity compensation can make a notable and lasting impact. If you are still confused and you need help navigating your options, please reach out to us. We’d love to be your second opinion.

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.