The Cost of Kids

- June 10, 2021

Share this article

1-877-Kost-of-Kids

While for many, one of life’s greatest joys is being a parent, there is also an underlying financial burden that comes with the job. Unsurprisingly, raising a child can be expensive. From diapers and baby food during infancy, to dance classes and flute lessons during their teen years, costs quickly add up. Then there’s the big-ticket items, which for some families could mean conceiving in cases of infertility, education, and weddings, just to name a few. Every parent wants what is best for their children, so we aren’t going to write about the ways to “cut corners” in the expense category, but we have outlined some practical tips below that can ease the financial burden and expectations that come along with children.

#1: Prepare for the Unexpected

When it comes to the future of your family, there is no downside to being over-prepared. Always assume that the costs associated with having kids will be higher than you expect and save more than you think you need. Additionally, it’s important to note that these needs can change over time as your family enters into different life stages. Because of this, it’s a good idea to revisit and make changes to your plan over time. While nobody ever thinks that the “unexpected” will happen to them or their family members, it’s much better to have the peace of mind that comes with being prepared and to never have to fall back on that plan. Once you have children, a life insurance policy is the best way to ensure your family can continue living their normal lifestyle if something were to happen to an income earner in the household. Another way to make sure you are prepared is to have a will and/or trust in place. Again, if something were to happen to someone in your family, this enables you to select where your assets go and who becomes the guardian of your children, instead of letting the courts decide. Having a great family healthcare plan is another way to ensure that your family is covered in the event of something unexpected (accident, injury, or illness). On a smaller scale, prepare to face the day-to-day challenges head on. Having the savings you need to pay for the extra tutor or developmental specialist will also provide peace of mind that you are ready for anything as a parent. When it comes to your family, it’s always better to have the support that you don’t need than to not have the support that you do need.

#2: Childcare and Education

Where you choose to live and the childcare option that you select are the two biggest factors when it comes to childcare cost. In the very beginning, check to see what your paternity and/or maternity leave policies look like. If your family is lucky enough to have two leave policies, it may make sense to stagger them to spend more time at home with your new family member. Additionally, the proximity to close family and friends who are willing to step in when you need help could be an important factor in determining where you choose to raise your family. As your child gets older, this becomes a question on education. If you plan to help your child pay for higher education, open a 529 account as early on as you can. Your contributions can grow tax-deferred and are distributed income tax-free as long as distributions are used for qualified education expenses.

#3: Buy one and get one 25% off!

There’s an economies of scale factor to keep in mind when you have your first child. Each additional child that your family welcomes will be slightly less expensive than the previous one. Even though it may be exciting to splurge here and there on your kids, remember that they really only fit into their clothes and play with their toys for about six months to a year before moving onto the next size / toy. If you keep a lot of the baby clothing and large-purchase items gender neutral, they can be re-used if you decide to have more children. For example, buy a red bike instead of the pink one with tassels. This also should be considered when choosing what childcare option is the best for your family. At a certain point, it may be more affordable to hire a full or part time nanny versus paying for three children to attend daycare or afterschool programs. Not only does this apply to cost, but it also can be applied to your time. If both of your children can play on the same sports team (or at least practice at the same place & time), attend the same school, or participate in the same afterschool art class, it will save you the extra trip, so you don’t have to make a similar trip twice. Of course, each child may have different needs and interests so you will want to prioritize which economies of scale will work for you and your family and which ones simply aren’t a great fit.

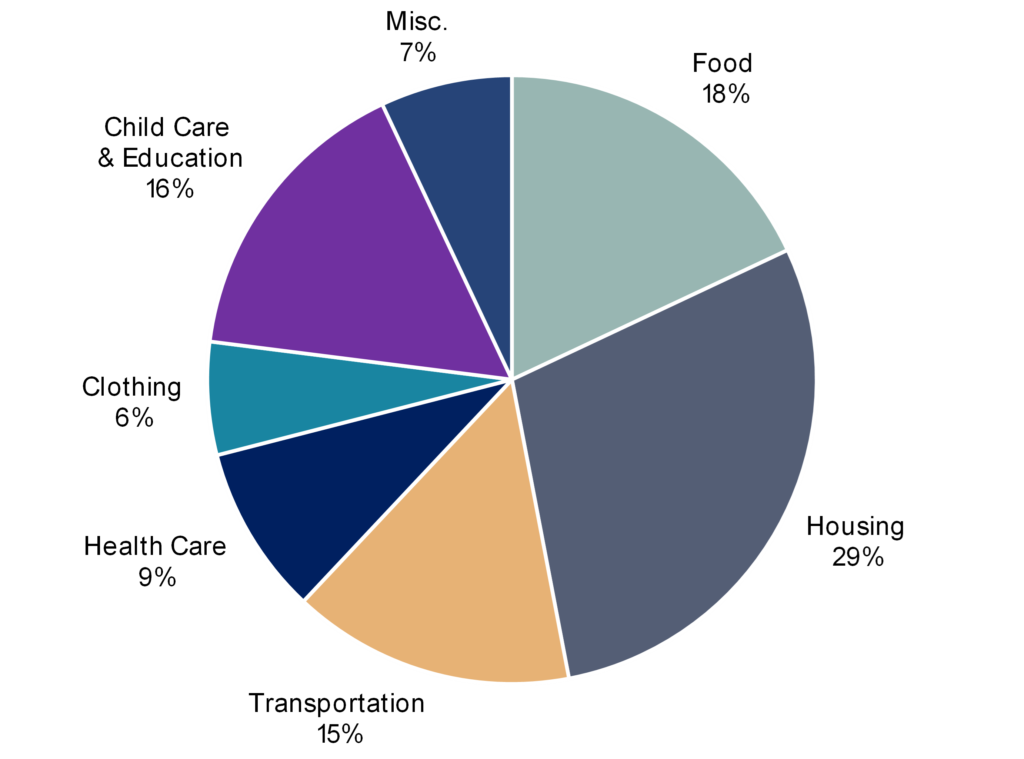

As of 2017, the cost of raising a child up to the age of 17 in the United States averaged $233,610, not including the cost of a college education. This number changes drastically depending on income status as well as the number of parents raising the child. A lower income single parent spends on average $172,200 to raise a child while a higher income married couple spends closer to $372,210. Location is another factor that could have a dramatic impact on this figure as well. According to the Annual Consumer Expenditures Survey from the USDA, below is the breakdown in cost of those first 17 years:

Being prepared for the financial responsibility that comes with having children is a critical step in your parenthood journey. At Treehouse Wealth, we take the time to get to know you and your family situation, understand your preferences, and appreciate your goals in order to create a tailored plan that will help you build a strong financial foundation and a legacy that lasts for your future generations. Contact us today to see how we can help with your family plan.

Subscribe To Our Newsletter

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.