401K 101: Understanding the Basics

- June 15, 2022

Share this article

Life is an adventure, and all adventures take planning. Many talk about retirement as an end game, but at Treehouse we view retirement as your next chapter in life. One of the most powerful retirement planning tools you can have is access to a company-sponsored 401K account. These tax-advantaged plans give employees the ability to set aside funds for retirement that can then grow tax-free until they are needed. If the plan is a traditional 401K, contributions to the account reduce the amount of income on which you must pay federal income tax. The funds grow tax-free, and when you retire, you’ll pay taxes on the amount you withdraw each year. If the plan is a Roth account, you don’t get the tax deduction for contributions, but you still get the tax-free growth, and when you start taking distributions in retirement, you won’t pay taxes on them.

Whether your account is a traditional or a Roth account, you gain the tremendous advantage of tax-free compounding and growth in the account. Some plans even include a matching contribution from the employer, which sweetens the deal for employees even more. For persons with ten, twenty, or more years to retirement, all this can really add up, making your 401K account a major advantage for retirement planning.

Let’s take a look at a few basics of 401K plans, including questions you need to answer before investing in an employer-sponsored plan.

Employer-Sponsored

As mentioned above, a 401K plan (named for the section of the Internal Revenue Code that establishes and defines it) is an employer-sponsored savings plan available to employees of for-profit companies. Each plan must include:

• a plan document,

• a trustee to hold plan funds,

• certain recordkeeping standards,

• required disclosures to plan participants (employees).

Qualified (i.e., tax-advantaged) retirement plans fall under the Employment Retirement Income Security Act of 1974 (ERISA), which requires that employers offering such plans must meet certain standards, including established guidelines for which employees are eligible to participate, amounts and schedules for any employer-matched contributions, how long you must work for the employer to be fully vested (i.e., to have complete ownership of your account), amounts of any fees associated with the plan, and other requirements for qualified retirement plans.

The plan document specifies what types of investments are available with the plan and also includes information on vesting schedules, beneficiaries, what happens to your account when you leave the employer, and other aspects of the plan.

Plan Expenses

As mentioned, the plan sponsor (employer) must provide certain information to each plan participant (employee). This includes information about any fees or expenses associated with the plan. This is important because directly or indirectly, any fees coming out of the plan can affect the amount you can save for retirement.

Typically, the majority of the fees paid by 401K plans are investment fees, which are deducted from funds invested in the account to compensate the mutual fund companies or other financial institutions that are providing the various investment options for the plan. It’s important to understand that fees can vary, so you should carefully review the fee information for the various investment options in your plan. In addition to investment fees, your plan may charge for other expenses such as recordkeeping, compensation for trustee services, and other functions necessary for administering the plan.

Can You Take It with You?

It’s also important to understand the circumstances and time frames for what happens to the money in your account if you leave your employer or retire. This information will be spelled out in the plan document, and each employer may have somewhat different requirements. However, the IRS generally requires that all plans must offer 100% vesting after no more than six years of service as defined by the employer. The maximum annual contribution you can make (for 2022) is $20,500 (plus an extra $6,500 if you’re 50 or older).

This is important to keep in mind, especially since the typical Millennial may change jobs more than twenty times during their career. Does that mean you might wind up with twenty or more 401K accounts?

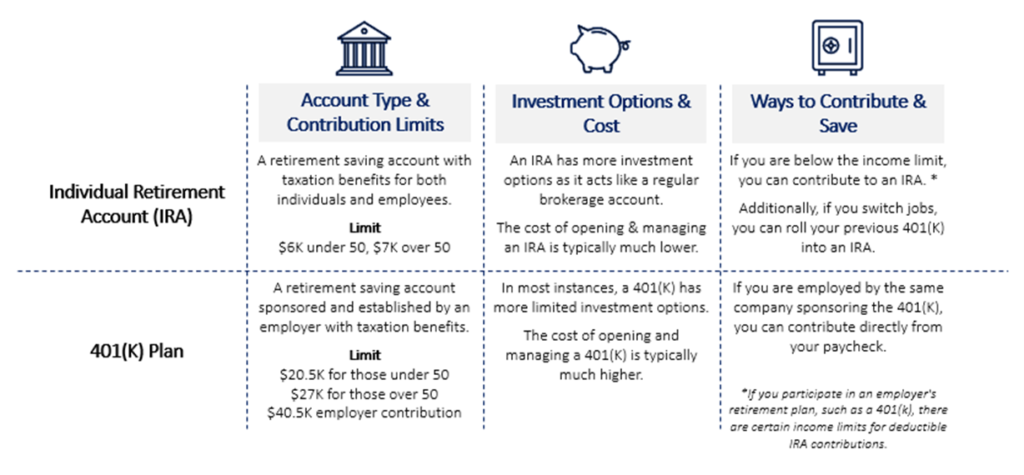

Not necessarily. You can typically roll your 401K account into an Individual Retirement Account (IRA) that is not associated with any employer. Rolling over your 401K into an IRA also will not create any tax consequences, which is not the case if you take money out of your 401K before age 55, which will typically generate a 10% tax penalty in addition to regular income tax on the amount withdrawn.

Why would you want to do a rollover from your 401K into an IRA? Well, first of all, this will allow the funds in your account to continue accumulating tax-free. Also, because you control the investment options in your IRA, you would potentially have a larger selection of investments to choose from, since you’re no longer limited by the menu in the 401K plan document. In the case of persons who have worked for several employers, the rollover is also a way to keep all the funds in one place, which can make it much easier to monitor how your investments are performing. Finally, because you own the IRA, it is fully portable; you can take it with you wherever you go and whomever you work for, and you can continue to make contributions up to the annual maximum ($6,000 in 2022, plus an extra $1,000 if you’re 50 or older) until you’re ready to start drawing it down in retirement.

Are there any disadvantages to rolling your 401K over to an IRA? Well, if you’re 55 and you’re leaving your employer, rolling the funds into an IRA will mean you can’t start withdrawing them for 4 ½ extra years. Most 401K plans allow withdrawals starting at age 55 with no 10% tax penalty, but with an IRA, you must wait until age 59 ½ for the same privilege. There are also certain creditor protections associated with 401K plans that IRAs do not enjoy, so if you are in a precarious legal situation, that could be a major consideration.

At Treehouse Wealth Advisors, our clients’ best interest is our top priority—always. We specialize in providing our clients advice on retirement plans, investment management, and other topics vital to long-term financial success. To learn more, click here to read our recent article, “The Evolution of Retirement.”

Subscribe To Our Newsletter

Sources:

- https://www.bls.gov/opub/btn/volume-5/spending-patterns-of-older-americans.htm

- https://www.cnbc.com/2018/08/08/4-ways-real-estate-can-boost-your-retirement-income.html

- https://www.fidelity.com/viewpoints/retirement/managing-cash-flow

- https://www.census.gov/data/tables/2019/demo/wealth/state-wealth-asset-ownership.html

- https://fred.stlouisfed.org/series/MSPUS

- https://www.fedweek.com/retirement-financial-planning/most-retirees-never-move-to-new-home-study-finds/

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.