College Tuition: Pricey or Priceless?

- September 8, 2021

Share this article

College tuition is expensive…that’s not news to any of us. The real question is, is it worth the price tag? Let’s examine two scenarios. Two friends, Carly and Annelise, both born in 1998, grew up one block from each other in the Bay Area. Both girls graduated from high school, but only Carly’s parents had prioritized saving for her college education. Carly decided to go to school at UC Davis and graduated four years later with a degree in marketing. Annelise, on the other hand, decided she didn’t want to fall into debt, so instead of going to college, she found a minimum wage job at a children’s center. In the four years she has been there, she too has become interested in marketing and in recognition of her work, , the program director has given Annelise the added responsibility of spearheading marketing. She has received a $4 per hour raise (bringing her hourly wage to $17) and a title change. At age 22, despite living paycheck to paycheck, Annelise is quite proud of herself. Contrast this scenario with Carly’s. Through her alumni network, Carly was able to find a job as a marketing associate at a marketing agency with a starting salary of $60K, plus benefits. In a year and a half, she will be promoted to marketing manager with a substantial salary increase, and her company will even offer to pay for her to obtain her MBA.

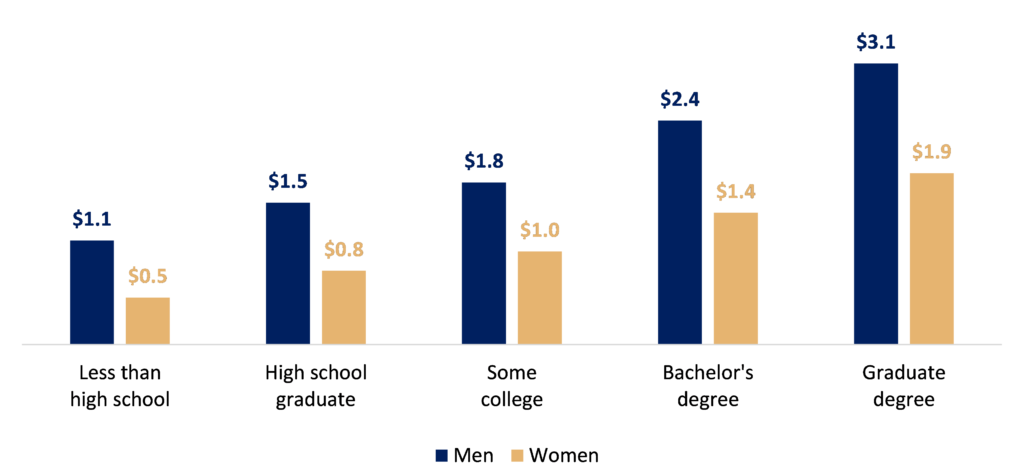

Estimated Lifetime Earnings by Education Attainment (in millions of dollars)

And yes, we are alarmed at this chart too! For more information on the gender gap and what we can do about it, read our recent blog post linked here.

Source: https://www.ssa.gov/policy/docs/research-summaries/education-earnings.html

As you can see from the scenario and chart above, and as research continues to show us, there are many long-term benefits of obtaining a higher education. While college isn’t necessarily the right choice for everyone, having the option to go to school and earn a degree can open many doors and provide a world of opportunity. Here are some of the most common ways a parent can save for their child’s education.

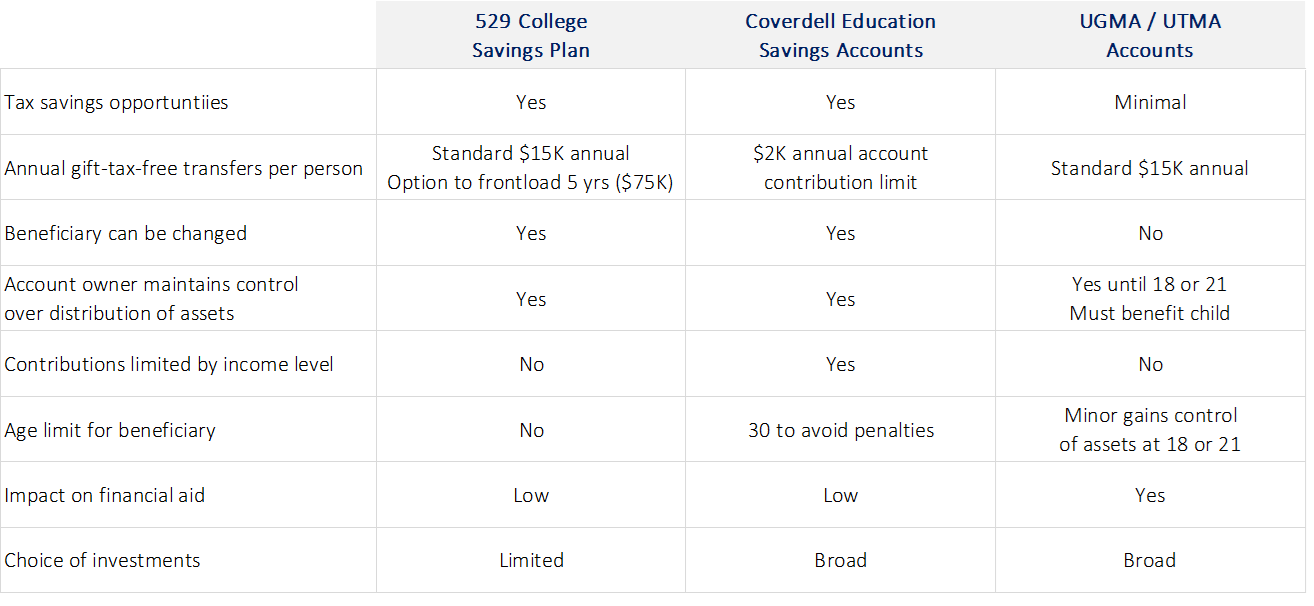

Tax-Free 529 Plan

Tax-free 529 plans are a common way to save for education and are used by an estimated 37 percent of parents in the United States, and for good reason! 529 plans offer a lot of flexibility when it comes to educational expenses, contributors, and beneficiaries. Although contributions are not tax deductible, if distributions are made for qualified education expenses, there are no taxes due on any gains in the account. The money in a 529 account can be used for K-12 tuition, college expenses including tuition, fees, books, room and board, student loan repayments, special needs expenses, and apprenticeship programs / courses throughout one’s career with no restrictions on the beneficiary’s age. The account owner always retains control of the account and can make investment choices, no matter the age of the beneficiary. Additionally, the beneficiary can easily be changed without any ramifications. For example, if your oldest child is 18, has a fully funded 529 plan, and receives a sports scholarship to attend college for free, your 3-year-old child can become the new beneficiary of their 529 plan.

Contributions into a 529 plan are not subject to a gift tax if they remain within the $15,000 annual limit. However, a major perk of 529 plans is that contributions can be frontloaded by 5 years ($75,000 per person / $150,000 per couple) without eating into one’s lifetime gift-tax exclusion. There are also no income limits for contributors. A 529 plan has low impact on a student’s additional financial aid eligibility if it is a parent or guardian who is the owner of the account. Grandparents, for example, can easily contribute to a grandchild’s plan but, to protect eligibility for a need based financial aid plan, we suggest the parent or guardian remain the owner of the account.

Coverdell Education Savings Accounts

A Coverdell Education Savings Account, or Coverdell ESA, is another type of investment account designed to help pay for a child’s education. A Coverdell ESA can be established for a child 18 years or younger or for an individual of any age with special needs. Once an investment has been made in a Coverdell ESA, there are no taxes on investment gains in the account if they are withdrawn for education expenses (such as K through 12 tuitions, supplies, tutors, equipment, college etc.) before the beneficiary turns 30 (except for special needs cases). If the account is still funded when the beneficiary turns 30, the funds will be disbursed, which will come with taxes, penalties, and fees. However, the account can also be transferred to a family member (defined loosely as siblings, parents, stepsiblings, in-laws, a child or stepchild, etc.) who is under 30 years old.

While there are limited investment options for 529 accounts, Coverdell ESA accounts have a much wider choice of investment vehicle options.. Coverdell ESA accounts do come with certain income eligibility limits as well as contribution limits. Each beneficiary can receive $2,000 annually in a Coverdell ESA, no matter who the contributor is. For example, if a grandparent chooses to fund the account with $2,000 one year, an aunt cannot also contribute that year. However, a child may have both a 529 as well as a Coverdell ESA account set up in their name. Like a 529 account, the Coverdell ESA account has little impact on a student’s financial aid eligibility should they need it.

Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) Accounts

While UGMA and UTMA accounts are not specifically meant for education expenses, they can play a role in saving for schooling and other expenses for a child. Each account is established for a child’s benefit and parents or whoever sets up the account can decide how it is invested and distributed until the child reaches a certain age (18 or 21 depending on the state). Once that age is reached, the child assumes full control of the account and can distribute the assets as they see fit. There aren’t as many tax savings benefits to UGMA/UTMA accounts compared to other education investment accounts, but the benefits include the broad range of asset classes and investment vehicles one can invest in and more flexibility in the use of the funds. In certain circumstances where the parent is reporting the child’s income on their own tax return, then the first $1,100 of annual unearned income is tax-free, the next $1,100 is taxed at the child’s rate, and the rest is taxed at the parent’s tax rate.

Let’s revisit the child who received a full scholarship for college. If they were an only child or the youngest in their family and had no other family members with education expenses coming down the pipeline, an UGMA/UTMA account may make more sense because it would simply transition to a savings account for the child once they reached the age of majority. However, there is less control over how the money is spent once that age is hit. There are no restrictions on contributions aside from general gift maximums and many different types of asset classes can be gifted (instead of just cash). Once a gift is made to an UTMA/UGMA it is irrevocable, meaning it cannot be taken back. Generally, this type of account also has a higher impact on a student’s financial aid eligibility because it counts as their asset.

The prospect of paying for college might seem daunting, but when you consider the extensive benefits higher education provides, it’s easy to see that it’s worth it.

For more information on how you can fit college savings into your overall financial plan, reach out to the Treehouse Wealth Advisors team. Remember, it’s never too early or too late to begin to build a solid foundation for your child’s future.

Subscribe To Our Newsletter

Sources:

- https://www.tc.columbia.edu/articles/2018/july/americans-believe-in-higher-education-as-a-public-good-a-new-survey-finds/

- https://am.jpmorgan.com/us/en/asset-management/gim/adv/products/college-savings-plan/college-planning-essentials

- https://www.fidelity.com/529-plans/what-is-a-529-plan

- https://www.schwab.com/resource-center/insights/content/saving-for-college-coverdell-education-savings-accounts

- https://www.merrilledge.com/ask/college/difference-between-529-utma-ugma

Garrison Point Advisors, LLC doing business as “Treehouse Wealth Advisors” (“TWA”) is an investment advisor in Walnut Creek, CA registered with the Securities and Exchange Commission (“SEC”). Registration of an investment advisor does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. TWA only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of TWA’s current written disclosure brochures, Form ADV Part 1 and Part 2A, filed with the SEC which discusses among other things, TWA’s business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov.

Certain hyperlinks or referenced websites, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top-level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with TWA with respect to any linked site or its sponsor, unless expressly stated by TWA. Any such information, products or sites have not necessarily been reviewed by TWA and are provided or maintained by third parties over whom TWA exercises no control. TWA expressly disclaims any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.